Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, December 23rd:

LPL Financial LPLA: This company which is a clearing broker-dealer and an investment advisory firm that acts as an agent for its advisors, on behalf of their clients, by providing access to a broad array of financial products and services, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.9% over the last 60 days.

LPL Financial Holdings Inc. Price and Consensus

LPL Financial Holdings Inc. price-consensus-chart | LPL Financial Holdings Inc. Quote

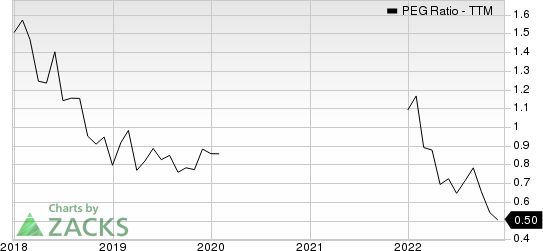

LPL Financial has a PEG ratio of 0.36 compared with 0.61 for the industry. The company possesses a Growth Score of A.

LPL Financial Holdings Inc. PEG Ratio (TTM)

LPL Financial Holdings Inc. peg-ratio-ttm | LPL Financial Holdings Inc. Quote

Rush Enterprises RUSHA: This company which operates the largest network of Peterbilt heavy-duty truck dealerships in North America and John Deere construction equipment dealerships in Texas and Michigan, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.9% over the last 60 days.

Rush Enterprises, Inc. Price and Consensus

Rush Enterprises, Inc. price-consensus-chart | Rush Enterprises, Inc. Quote

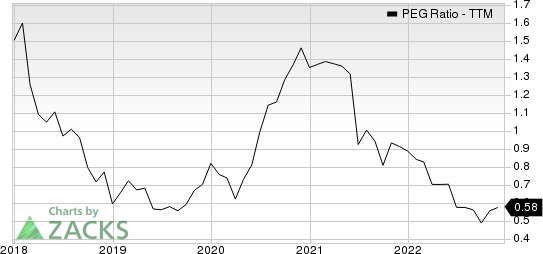

Rush Enterprises has a PEG ratio of 0.54 compared with 0.67 for the industry. The company possesses a Growth Score of B.

Rush Enterprises, Inc. PEG Ratio (TTM)

Rush Enterprises, Inc. peg-ratio-ttm | Rush Enterprises, Inc. Quote

Hudson Technologies HDSN: This company which is a leading provider of innovative solutions to recurring problems within the refrigeration industry, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 20.7% over the last 60 days.

Hudson Technologies, Inc. Price and Consensus

Hudson Technologies, Inc. price-consensus-chart | Hudson Technologies, Inc. Quote

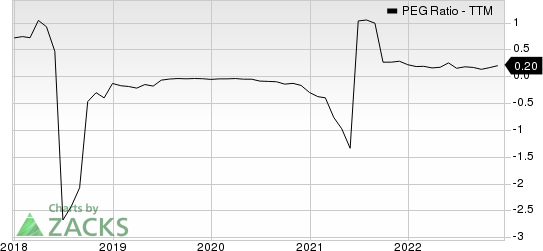

Hudson Technologies has a PEG ratio of 0.15 compared with 0.41 for the industry. The company possesses a Growth Score of B.

Hudson Technologies, Inc. PEG Ratio (TTM)

Hudson Technologies, Inc. peg-ratio-ttm | Hudson Technologies, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Hudson Technologies, Inc. (HDSN) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.