Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, December 14:

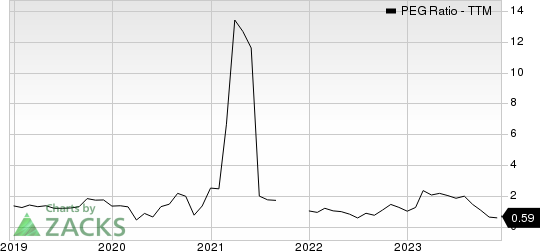

Griffon GFF: This company which provides consumer, professional, home, and building products carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.5% over the last 60 days.

Griffon Corporation Price and Consensus

Griffon Corporation price-consensus-chart | Griffon Corporation Quote

Griffon has a PEG ratio of 0.68 compared with 0.69 for the industry. The company possesses a Growth Score of A.

Griffon Corporation PEG Ratio (TTM)

Griffon Corporation peg-ratio-ttm | Griffon Corporation Quote

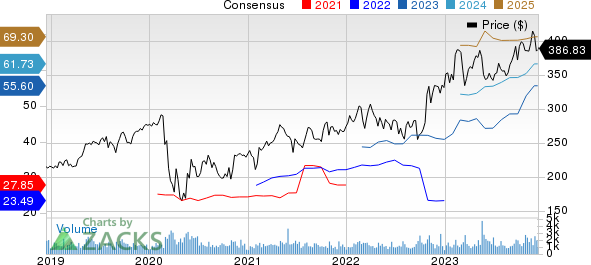

Brinker International, Inc. EAT: This casual dining restaurant company carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.9% over the last 60 days.

Brinker International, Inc. Price and Consensus

Brinker International, Inc. price-consensus-chart | Brinker International, Inc. Quote

Brinker International has a PEG ratio of 0.69 compared with 2.42 for the industry. The company possesses a Growth Score of A.

Brinker International, Inc. PEG Ratio (TTM)

Brinker International, Inc. peg-ratio-ttm | Brinker International, Inc. Quote

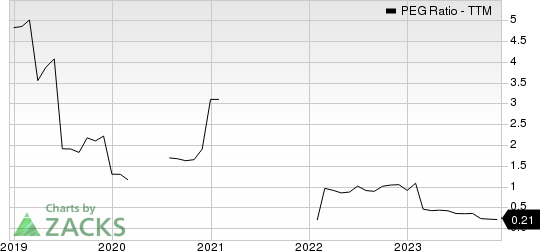

Everest Group, Ltd. EG: This company that provides reinsurance and insurance products carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.8% over the last 60 days.

Everest Group, Ltd. Price and Consensus

Everest Group, Ltd. price-consensus-chart | Everest Group, Ltd. Quote

Assurant has a PEG ratio of 0.19 comparedwith 0.77 for the industry. The company possesses a Growth Score of B.

Everest Group, Ltd. PEG Ratio (TTM)

Everest Group, Ltd. peg-ratio-ttm | Everest Group, Ltd. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.