Thermo Fisher Scientific TMO is a scientific instrument maker and a world leader in serving science. The company has three segments: Life Sciences Solutions, Analytical Instruments, and Specialty Diagnostics.

Analysts have slashed their earnings expectations across the board, landing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at how the company currently stacks up.

Thermo Fisher Scientific

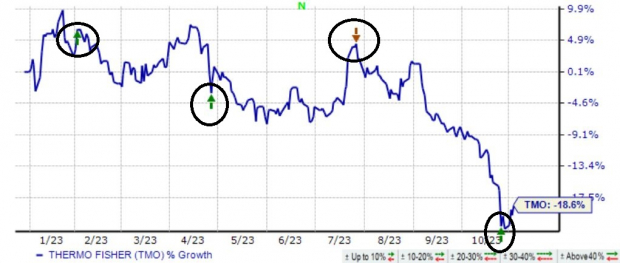

It’s been a bumpy road for TMO shares year-to-date, down nearly 19% and unable to establish consistent strength. As we can see by the arrows circled below, shares have faced adverse recactions post-earnings in several instances throughout 2023.

Image Source: Zacks Investment Research

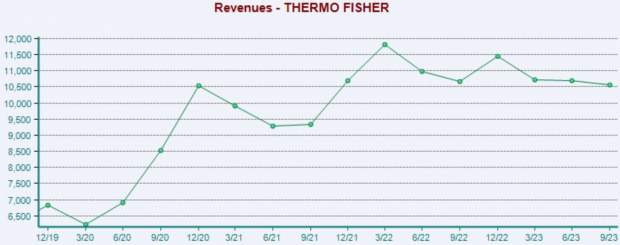

In its latest release, the company beat the Zacks Consensus EPS Estimate by 2% and posted a fractional revenue surprise. Earnings saw growth of 12% year-over-year, whereas revenue declined by roughly 1% from the year-ago period.

Image Source: Zacks Investment Research

In addition, Thermo Fisher lowered its FY23 guidance following the results, citing a challenging macroeconomic environment. The company now expects FY23 sales to be $42.7 billion and adjusted EPS of $21.50.

It’s worth noting that Thermo Fisher had already lowered FY23 guidance back in July, further reflected by share performance over the last several months.

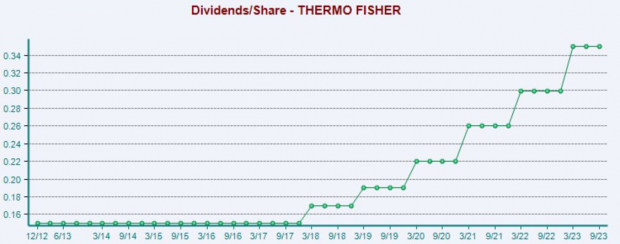

The company has gone a long way in growing its dividend payout, carrying a sizable 16.5% five-year annualized dividend growth rate and reflecting its shareholder-friendly nature. TMO’s payout ratio sits at just 7% of its earnings.

Image Source: Zacks Investment Research

Bottom Line

Recent guidance cuts due to a challenging macroeconomic environment paint a challenging picture for the company’s shares in the near term.

Thermo Fisher Scientific TMO is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.