Ciena Corporation CIEN is a global service provider that supports the routing, delivery, and management of video, data, and voice traffic on communications networks. The company offers hardware networking products, operating system software, multi-domain services and analytics. CIEN sells its products through direct and indirect sales channels to various network operators.

The Zacks Rundown

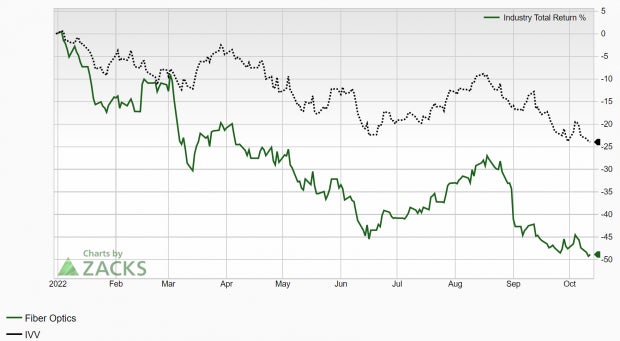

CIEN, a Zacks Rank #5 (Strong Sell), is a component of the Zacks Fiber Optics industry group, which ranks in the bottom 1% out of more than 250 Zacks Ranked Industries. As such, we expect this industry group as a whole to underperform the market over the next 3 to 6 months. This industry has underperformed the market at nearly every turn this year:

Image Source: Zacks Investment Research

Candidates in the bottom tiers of industries can often be solid potential short candidates. While individual stocks have the ability to outperform even when included in a poor-performing industry group, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much more difficult.

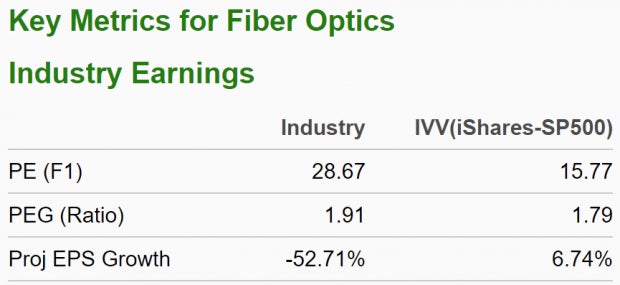

Note the unfavorable characteristics for this group below:

Image Source: Zacks Investment Research

CIEN experienced a climax top in December of last year and has been in a price downtrend ever since. The share price is hitting a series of 52-week lows and represents a compelling short opportunity as the market continues its downward momentum into the fourth quarter.

Recent Earnings Misses & Deteriorating Outlook

CIEN has fallen short of estimates in three of the last four quarters. The networking company most recently reported fiscal Q3 earnings last month of $0.33/share, missing the $0.35/share consensus EPS estimate by -5.71%. CIEN has posted a trailing four-quarter average earnings miss of -3.57%. Consistently falling short of earnings estimates is a recipe for underperformance, and CIEN is no exception.

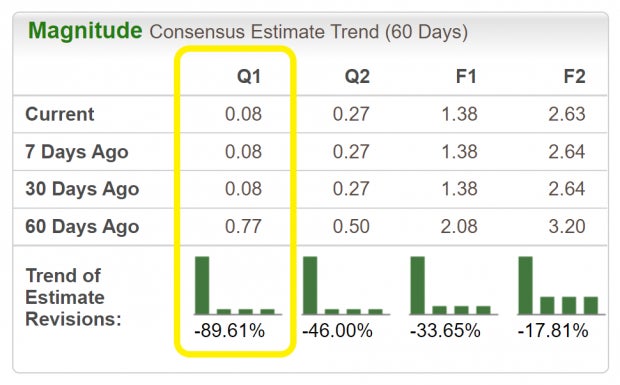

Ciena has been on the receiving end of negative earnings estimate revisions as of late. For the fiscal fourth quarter, analysts have decreased estimates by 89.61% in the past 60 days. The Q4 Zacks Consensus EPS Estimate is now $0.08/share, reflecting a -90.59% regression relative to the same quarter last year.

Image Source: Zacks Investment Research

Falling earnings estimates are a huge red flag and need to be respected. Negative growth year-over-year is the type of trend that bears like to see.

Technical Outlook

As illustrated below, CIEN is in a sustained downtrend. Notice how the stock has plunged below both the 50-day and 200-day moving averages signaled by the blue and red lines, respectively. The stock is making a series of lower lows, with no respite from the selling in sight. Also note how both moving averages have rolled over and are sloping down – another good sign for the bears. Shares have fallen nearly 48% this year alone.

Image Source: StockCharts

While not the most accurate indicator, CIEN has also experienced what is known as a “death cross”, wherein the stock’s 50-day moving average crosses below its 200-day moving average. CIEN would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock.

Final Thoughts

A worsening fundamental and technical backdrop show that this stock is not set to make its way back to new highs anytime soon. The fact that CIEN is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns. A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

Our Zacks Style Scores depict a weakening outlook for this stock, as CIEN is rated a worst-possible ‘F’ in our both our Growth and Value categories, paving the way for another ‘F’ in our overall VGM score. While this market remains quite difficult, it’s easy to understand why investors should steer clear of this poorly rated stock.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ciena Corporation (CIEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.