Sam Altman’s ousting as CEO of OpenAI sent shockwaves through the tech world and grabbed headlines this morning after he was selected to lead Microsoft’s MSFT “new advanced AI research team”. Altman co-founded OpenAI in 2015 with Greg Brockman, the company’s former president who will be joining Microsoft as well after protesting Altman’s removal by the OpenAI board of directors.

While OpenAI is still a private company it’s renowned for its progress and development of artificial intelligence as the creator of the popular AI application ChatGPT. For Microsoft, the talent pool that Altman could bring may lead to a competitive advantage in the AI realm, particularly in the enterprise framework.

With many OpenAI employees wanting to follow Altman to Microsoft, this could also keep Amazon AMZN and Alphabet GOOGL at bay as it relates to superior enterprise AI applications and may have investors wondering if it’s time to buy MSFT shares.

Microsoft’s AI Capabilities

Notably, Microsoft is the largest shareholder in OpenAI forming a partnership with the tech startup after investing $1 billion into the company in 2019. Microsoft is also the exclusive provider of cloud computing enterprises to OpenAI.

Microsoft AI, powered by its Azure cloud, integrates artificial intelligence into many of its products and services including Windows, Xbox, Microsoft 365, Microsoft Teams, and Defender among others. Microsoft’s stock is up +58% this year and the software giant is seen as the leader among enterprise AI applications with Alphabet thought to have the largest consumer-related capabilities while e-commerce titan Amazon is also in the mix.

Image Source: Zacks Investment Research

Growth & Valuation

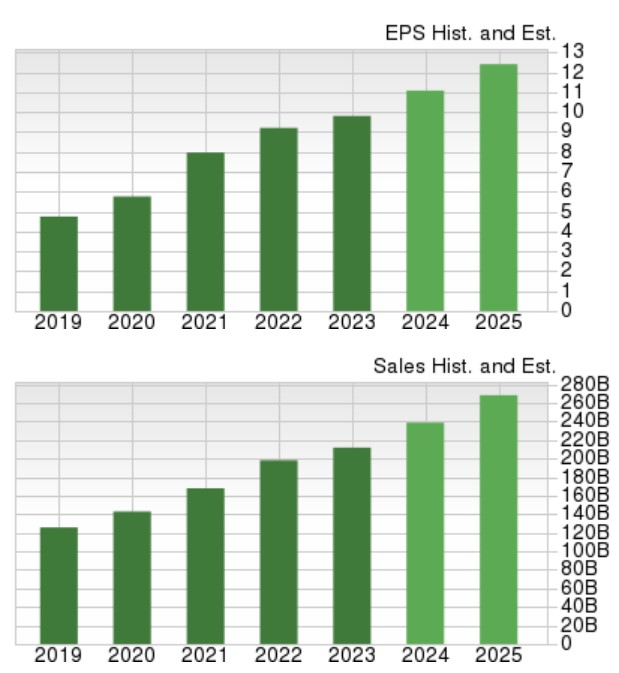

With its products and services being enhanced by AI, Microsoft’s annual earnings are currently forecasted to rise 13% in its current fiscal 2024 and jump another 14% in FY25 to $12.71 per share. On the top line, total sales are projected to be up 14% in FY24 and climb another 13% in FY25 to $274.82 billion.

Image Source: Zacks Investment Research

Microsoft’s stock currently trades at 33.2X forward earnings which is a premium to the S&P 500’s 21.1X but a slight discount to the Zacks Computer-Software Industry average of 36.3X and is a clear-cut leader in the space.

Image Source: Zacks Investment Research

However, in terms of price to sales, Microsoft’s P/S ratio of 11.3X is also above the benchmark’s 3.6X and its industry average of 7.3X.

Image Source: Zacks Investment Research

Bottom Line

While Microsoft’s stock was up +2% on today’s news of Sam Altman heading its AI research team, the valuation of MSFT shares does allude to the possibility of better buying opportunities ahead. For now, Microsoft’s stock lands a Zacks Rank #3 (Hold).

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.