The Zacks Consumer Staples sector has held up relatively well in 2022, down 13%, vs. the S&P 500’s decline of more than 20%.

Image Source: Zacks Investment Research

Companies in the sector can generate revenue in the face of good and bad economic situations thanks to their products being in consistent demand.

A widely-recognized name in the sector, Archer Daniels Midland ADM, is on deck to unveil quarterly earnings on October 25th, before the market open.

Archer Daniels Midland is one of the leading producers of food and beverage ingredients and goods made from various agricultural products.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How are things shaping up heading into the release? Let’s take a closer look.

Share Performance & Valuation

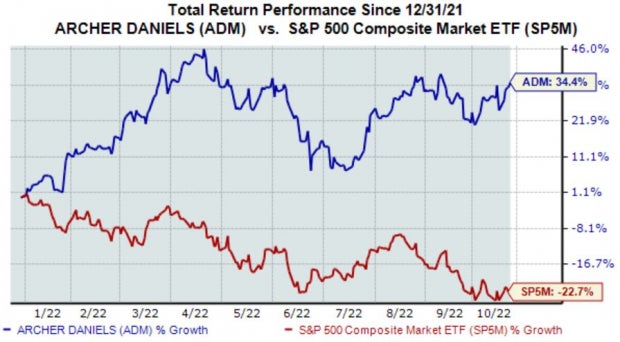

ADM Shares have been a bright spot in an otherwise dim market in 2022, up more than 30% and easily crushing the general market’s performance.

Image Source: Zacks Investment Research

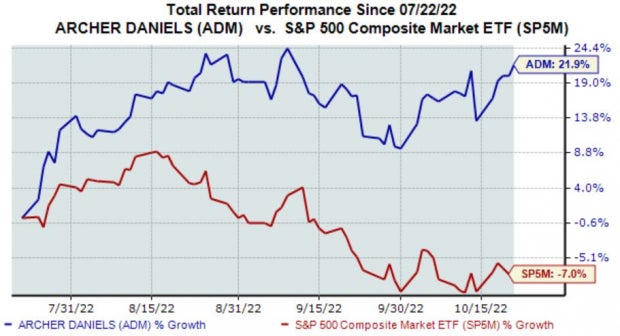

Over the last three months, ADM shares have continued on their market-beating trajectory, up a double-digit 22% vs. the S&P 500’s 7% decline.

Image Source: Zacks Investment Research

The positive price action of Archer Daniels Midland shares indicates that bulls have been in control, with massive buying activity.

Shares don’t appear expensive; the company’s 12.8X forward earnings multiple sits well beneath the five-year median of 14.2X and represents a 32% discount relative to its Zacks Consumer Staples sector.

ADM sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had a bullish stance on the company’s earnings outlook over the last several months, with four positive earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $1.42 suggests Y/Y earnings growth of a sizable 46%.

Image Source: Zacks Investment Research

The company’s top-line appears to be in good standing also – the Zacks Consensus Sales Estimate of $22.9 billion indicates Y/Y revenue growth of more than 12%.

Quarterly Performance & Market Reactions

Archer Daniels Midland is on an impressive earnings streak, exceeding the Zacks Consensus EPS Estimate in 12 consecutive quarters, with 11 double-digit percentage beats.

Just in its latest print, the company registered a strong 23% bottom-line beat.

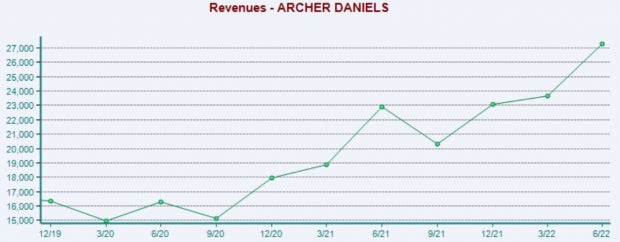

Revenue results have also been inspiring; ADM has chained together seven consecutive top-line beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, the market has cheered on its last three quarterly prints, with shares moving upward in each instance by at least 3%.

Putting Everything Together

ADM shares have provided investors with considerable returns in 2022, outperforming the general market across several timeframes.

Valuation multiples don’t appear stretched, with the company’s forward P/E ratio sitting beneath its five-year median and Zacks sector.

Analysts have been bullish on their earnings outlook, and estimates suggest sizable Y/Y upticks in revenue and earnings.

The company has been the definition of consistency, exceeding quarterly estimates repeatedly, and by sizable percentages.

Heading into the report, Archer Daniels Midland ADM carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 4.1%.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.>>Send me my free report on the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.