Options traders are piling on SCHW amid Silicon Valley Bank’s collapse

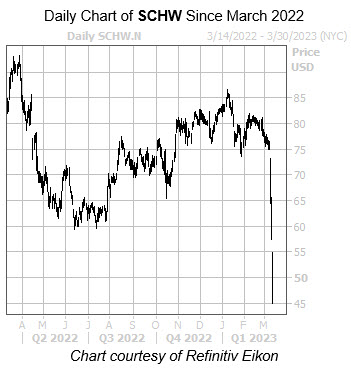

The bank sector is under pressure today amid the collapse of SVB Financial Group (SIVB). Charles Schwab Corporation (NYSE:SCHW) stock is down 10.7% at $52.43 at last check, as traders worry about regional lenders’ financial health amid interest rate hikes. Meanwhile, President Joe Biden today vowed to protect the U.S. banking system.

The recent headlines did not spook Citigroup, which upgraded SCHW to “buy” from “neutral.” The firm noted recent bear gaps have created an attractive entry point, but also slashed the security’s price objective to $75 from $83. The 12-month consensus target price of $89.85 is a 70.3% premium to current levels, indicating additional price target cuts may be on the horizon.

Options traders are not holding back, with overall options volume today running at 18 times the intraday average. So far, 200,000 calls and 163,000 puts have been traded. Most popular are the March 40 and 45 puts, where new positions are currently being opened.

Short-term options traders have been much more pessimistic than usual. This is per Charles Schwab stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.16, which ranks in the 97th annual percentile, suggesting these traders have rarely been more put-biased.

The security is on track for its third-straight daily loss, and fresh off its worst week on record. Shares earlier dipped to levels not seen since November 2020, and are trading below several long-term moving averages. In 2023 alone, SCHW already lost more than 36%.

Image and article originally from www.schaeffersresearch.com. Read the original article here.