The Zacks Finance sector has held up better than the general market in 2022, down 18% vs. the S&P 500’s decline of more than 20%.

A titan in the sector, American Express AXP, is on deck to unveil quarterly results on October 21st before the market open.

American Express is a diversified financial services company offering charge and credit payment card products and travel-related services worldwide.

Currently, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a C.

How does the financial titan stack up heading into its quarterly report? Let’s take a closer look.

Share Performance & Valuation

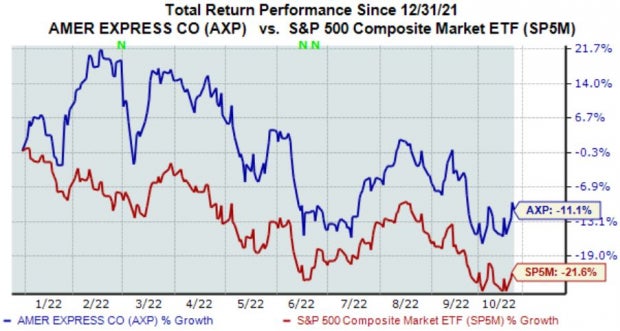

Year-to-date, AXP shares have displayed notable relative strength, down 11% and widely outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, the story has remained the same; AXP shares have continued to outperform the S&P 500, down roughly 3%.

Image Source: Zacks Investment Research

The relative price action strength indicates that buyers have defended shares much higher than most, clearly a positive in a historically volatile 2022.

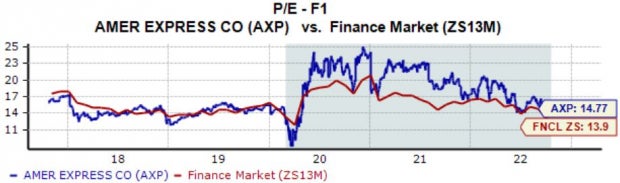

AXP’s 14.8X forward earnings multiple sits above its Zacks Finance sector, representing a slight 6% premium.

Still, the value is well below the five-year median of 15.6X and highs of 23.3X in 2021.

Image Source: Zacks Investment Research

AXP sports a Style Score of a B for Value.

Quarterly Estimates

Analysts have primarily been bullish in their earnings outlook, with three positive estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $2.38 suggests Y/Y earnings growth of a solid 5%.

Image Source: Zacks Investment Research

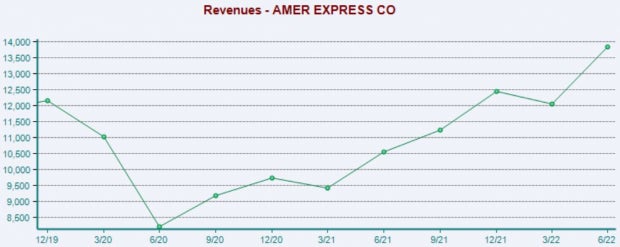

The company’s top-line looks to be in solid standing as well; the Zacks Consensus Sales Estimate of $13.5 billion indicates Y/Y revenue growth of a double-digit 24%.

Quarterly Performance & Market Reactions

AXP has been on an impressive earnings streak, exceeding revenue and earnings estimates in four consecutive quarters. Just in its latest print, American Express registered a 1.5% earnings beat and a solid 7.8% revenue beat.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, it’s worth noting that the market has reacted well in response to the company’s earnings releases, with shares moving upwards following five of its last six quarterly prints.

Putting Everything Together

AXP shares have outperformed the S&P 500 across several timeframes in 2022, indicating that buyers have been heavily present.

The company’s valuation multiples aren’t stretched by any means, with its forward earnings multiple sitting well below its five-year median.

Analysts have been bullish on their earnings outlook, and estimates suggest Y/Y growth in both revenue and earnings.

Further, AXP has consistently exceeded quarterly estimates as of late, and the market has liked what it’s seen from nearly all of its last six prints.

Heading into the release, American Express AXP carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of 1.4%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention. See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.