Alibaba will split into six businesses

Alibaba Group Holding Ltd (NYSE:BABA) announced Tuesday that the company will split into six businesses, each with the ability to raise outside funding, go public, and be managed by its own CEO and board of directors.

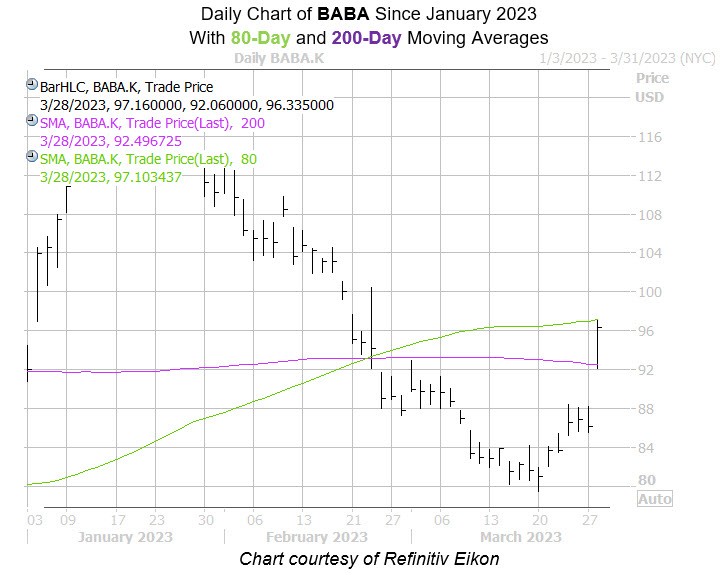

Alibaba stock is jumping in response. The shares were last seen 11.2% higher to trade at $95.74, moving back above their year-to-date breakeven and pacing for their best close in more than a month. More importantly, BABA late last month experienced a golden cross of its 80-day and 200-day moving averages — of which, the shares are now wedged between. This could indicated further gains for the equity in the coming weeks.

The China-based e-commerce giant’s options pits are exploding with activity today, too. Total options volume is running at quadruple the average intraday amount, with 446,000 calls and 119,000 puts exchanged so far. The weekly 3/31 100-strike call is leading the charge, followed by the June 100 call, and new positions are being opened at both contracts.

A broader look shows calls have been the popular options of late. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows BABA ‘s 10-day call/put volume ratio of 4.48 ranks in the elevated 99th annual percentile. Echoing this, the security’s Schaeffer’s put/call open interest ratio (SOIR) of 0.40 stands higher than just 2% of annual readings.

Now looks like a good time to weigh in on the security’s next move with options. The stock is seeing attractively priced premiums at the moment, per Alibaba stock’s Schaeffer’s Volatility Index (SVI) of 46%, which sits in the low 3rd percentile of its annual range. Plus, the equity’s Schaeffer’s Volatility Scorecard (SVS) of 87 out of 100 means the stock has exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.