Trading 30% from its highs, investors will want to pay attention to Albertsons ACI fiscal Q2 earnings on October 18. Albertsons is one of the largest food and drug retailers in the United States. Albertsons Companies operates Albertsons, Safeway, and Jewel-Osco, among others.

Kroger Merger

Today’s announcement revealed that Kroger KR is expected to pay $34.10 per share for Albertsons. However, Wall Street may not see the agreement getting done as this would be a considerable premium with ACI trading at $26 a share. ACI shares fell 8% after the news with KR shares down 7%.

The deal is valued at $25 billion and includes the assumption of about $4.7 billion of Albertsons debt. As part of the transaction, Albertsons will pay a special cash dividend of up to $4 billion to its shareholders.

Combining the companies would merge the largest and second-largest U.S. supermarket operators to provide greater scale and increase leverage in negotiations with vendors. Although both companies say the merger will cut consumer prices this could very well turn into a legal battle amid regulation concerns. The merger would see the joint company control 20% of the nation’s grocery market.

However, with or without the merger, ACI stock may be worth investors consideration as its growth outlook has become more intriguing.

Outlook

The Zacks Consensus Estimate for ACI’s fiscal Q2 earnings is $0.63 per share, which would represent a 1% decline from Q2 2021. The operating environment during the quarter may have drained the company’s earnings as sales are expected to be up 7% at $17.64 billion.

However, earnings for the quarter are up from 90 days ago at $0.61 per share. Full-year estimates are rising as well, with ACI’s current fiscal year 2023 earnings estimates recently ticking up to $2.94 but still down 4% from the prior year. And fiscal year 2024 earnings are now expected to rise 2% at $3.02 a share. Year over year, top line growth is expected as well, with sales expected to jump 5% in FY23 and another 2% in FY24 to $77.48 billion.

Performance

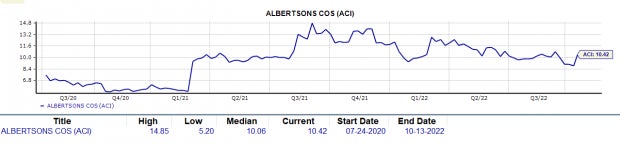

Year to date ACI is down -12% to outperform the S&P 500’s -23%. This also outperforms its peer group’s -14%. Even better, over the last two years, ACI is up +84% to crush the benchmark and its peer group’s -4%.

Image Source: Zacks Investment Research

Valuation

Albertsons currently trades around $26 a share with a forward P/E of 9.7X. This is below the industry average of 12.7X and well below its decade-high of 14.8X.

Image Source: Zacks Investment Research

Bottom Line

ACI currently lands a Zacks Rank #2 (Buy) with earnings revisions starting to trend up. Already trading at a discount relative to its past, the Average Zacks Price Target offers 20% upside from current levels. ACI offers a modest 1.68% annual dividend yield at $0.48 a share. And, the premium being paid by Kroger (KR) for the company’s merger values ACI closer to its 52-week highs and could eventually give the stock another short-term catalyst.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albertsons Companies, Inc. (ACI): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.