Every year, we at eToro write an investor’s almanac full of themes we think could transform the world. And of course, no 2024 trend piece is complete without AI.

One year ago, the AI craze was just getting started. ChatGPT was just a few months old, and Americans were coming around to the fact that AI can do a lot of what we can — but cheaper and better.

Today, the optimism continues, but with a tinge of noticeable caution. While AI is still a hot topic, the hype has simmered, and questions about its potential have started to surface.

The burden of proof

AI had incredible momentum in the first half of last year. According to some headlines, ChatGPT could write our emails, manage our money, read our minds, rebuild the middle class, and achieve world peace.

People believed in AI enough to invest, too. The AI craze tech helped save the stock market in 2023, with the Nasdaq 100 clocking its best return in two decades.

But in the latter half of the year, the facade started to crumble.

OpenAI manufactured one of the biggest corporate messes in decades when they fired — and rehired — Sam Altman in a matter of weeks. Wall Street is increasingly calling AI a bubble instead of a revolution. And instead of talking about what ChatGPT can do, we’re hearing more about what it can’t do — like tell a funny joke or play rock, paper, scissors.

Look, every young product goes through ups and downs. Gartner, a well-known technology research firm, calls this phase of AI the “trough of disillusionment” – or when people start to realize the technology may not actually live up to our lofty expectations.

AI’s momentum isn’t faltering, either. For every negative headline, there still seem to be 10 about how AI could change our lives. The burden of proof is just higher. We’ve heard all the incredible stories about what AI can do. Now, investors are looking for who can talk the talk and walk the walk. They need hard evidence that AI can boost profits.

And in the stock market, companies that show receipts could lead the next wave of the AI trade.

Closing the gap

Nvidia was the first major company to clear this hurdle. Nvidia beat its second- and third-quarter revenue targets by more than $2 billion each time, and analysts credited GPU demand for strong sales. Of course, the market noticed and Nvidia’s shares rallied 200% last year. Amazingly enough, though, Nvidia’s price-sales ratio ended the year around 14, an 11-month low.

Other companies have made headlines with glimmers of AI hope. IBM shares soared the most in four years on January 25 on comments that its generative AI business book more than doubled in the fourth quarter. And in December, AMD said it expects a total addressable market of $45 billion for its AI processors, up from a $30 billion estimate in June.

AI’s impact is starting to emerge. Still, there are a lot of unknowns, and I’m not sure the AI trade will be as easy this year as it was in 2023. For one, there’s a huge gap between tech and the rest of the market after the Magnificent Seven’s incredible 2023. If the economy continues to surprise, people may feel confident enough to search for value in cyclical stocks outside of tech.

Plus, if Wall Street is correct and AI stocks’ prices look too high for profits, you may have to dig for value using picks and shovels. Or, the picks and shovels trade, as it’s called in investing. Think about which businesses supply the classic AI companies, or could benefit from implementing AI technology.

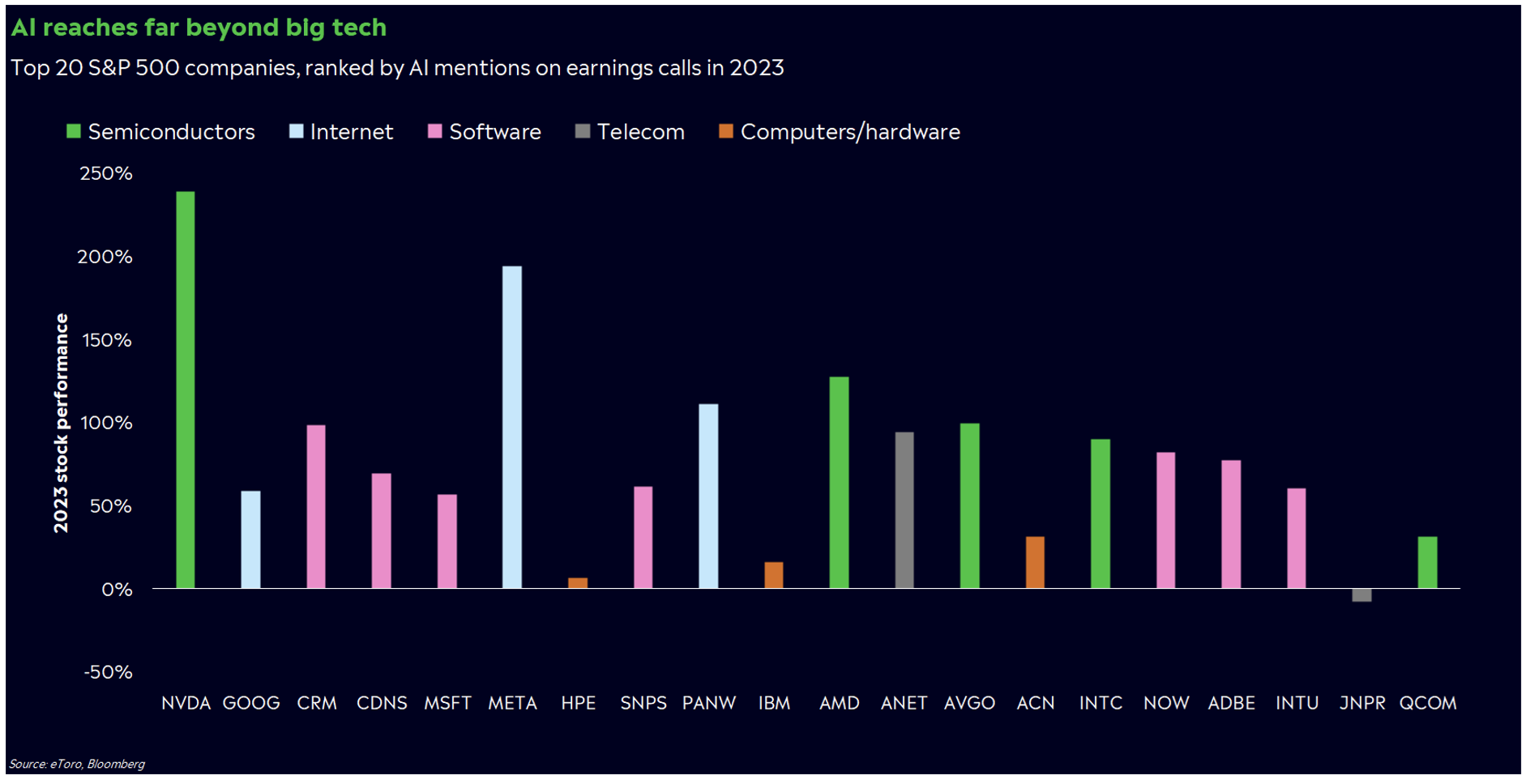

There could be a vast amount of possibilities for monetization, too. Look at the 20 S&P 500 companies that mentioned AI the most in earnings calls last year, and you’ll see five different industries: semiconductors, internet companies, software firms, telecom networks, and hardware makers. Not all of these names flourished last year, either. Three underperformed the S&P 500, and one even fell.

Companies are also in a good spot to experiment. Profits are rising, rates are falling, and productivity is gaining momentum. If AI is going to change the world, it’ll need companies to invest meaningfully in it — not just to boost profits, but to make our systems more efficient and resilient. This is the long-term view, and we’re certainly taking steps in that direction.

Like many of you, I’m excited about AI. And unlike many people on Wall Street, I’m not ready to call it a bubble yet. 2024 could show us just how transformative AI could be for corporate America — not just tech nerds.

If you want to read more research and analysis from eToro, check us out here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.