A widely-known mega-cap giant, Alphabet GOOGL, is slated to unveil quarterly results on October 25th, after the market close.

The company’s advertising results will undoubtedly be a critical metric of the release, as it’s a massive source of the company’s revenue.

By using the quarterly results we’ve already received from Snap SNAP, we can better understand how the advertising market currently stacks up.

Let’s take a closer look.

Advertising Market Cooling?

Snap reported Q3 earnings of $0.08 per share, beating the breakeven Zacks Consensus EPS Estimate and reflecting a 50% Y/Y decline.

Snap raked in $1.1 billion in revenue throughout the quarter, missing the Zacks Consensus Sales Estimate by roughly 1.5% but reflecting a 6% Y/Y uptick.

However, the digital advertising market has faced a few speedbumps.

In a letter to its shareholders, SNAP says, “We are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.”

Clearly, that isn’t good news to hear if you’re Alphabet, which also heavily relies on advertising revenue.

For the quarter, the Zacks Consensus Estimate for Alphabet’s advertising revenue sits at $57.6 billion, suggesting a 2.4% sequential increase and a 12% Y/Y uptick.

In its latest quarter, Alphabet’s advertising revenue came in at $56.2 billion, missing the Zacks Consensus Estimate by a marginal 0.3%, breaking a streak of positive surprises.

Share Performance & Valuation

Alphabet shares have experienced adverse price action YTD, down nearly 30% and underperforming the general market by a wide margin.

Image Source: Zacks Investment Research

Over the past three months, however, GOOGL shares have traded in line with the general market, down just under 5%.

Image Source: Zacks Investment Research

While the year-to-date price action of GOOGL shares leaves much to be desired, the near-term price action indicates that sellers could be losing control.

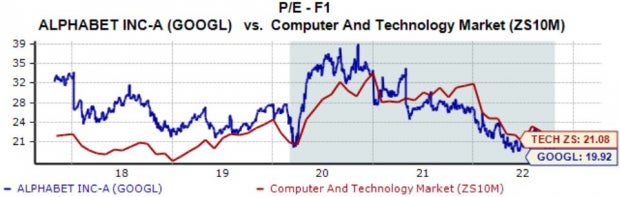

Following the sell-off in 2022, GOOGL shares have become relatively cheap; the company’s 19.9X forward earnings multiple is well beneath its 26.7X five-year median and reflects a 6% discount relative to its Zacks Computer and Technology sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish in their earnings outlook, with two negative earnings estimate revisions coming in over the last several months. The Zacks Consensus EPS Estimate of $1.25 suggests a Y/Y earnings decline of roughly 10%.

Image Source: Zacks Investment Research

However, the company’s top-line is in better health; the Zacks Consensus Sales Estimate of $58.4 billion indicates year-over-year revenue growth of nearly 9%.

Bottom Line

With Snap witnessing a slowdown in advertising, it’s valid to compare the company’s quarterly results to see how it could compare to Alphabet’s upcoming release.

Currently, the Zacks Consensus Estimate for GOOGL’s advertising revenue indicates a sequential and Y/Y uptick, undoubtedly a positive.

Alphabet has struggled to exceed quarterly estimates as of late, falling short of the Zacks Consensus EPS and Sales Estimates in back-to-back quarters.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.