Anti-financial crime (AFC) operations have been rapidly evolving over the past several years as regulatory pressures and competitive forces drive banks to invest in more effective and efficient systems. As banks seek to improve data collection analytics and decision-making processes, many AFC operations are moving toward hyperautomation to accelerate their transformation. A new report by Chartis Research, in partnership with Nasdaq, explores the journey to hyperautomation and how banks can deliver long-term success.

Hyperautomation utilizes a combination of tools and techniques, including robotics, machine learning, artificial intelligence and no-code approaches, to maximize the level of automation in a set of processes, thereby removing as much manual activity as possible. According to the report, hyperautomation can not only enable banks to make their data gathering, operations and analytics activities incrementally more efficient, but it can also help to automate more complex, decision-based activities as well.

The Chartis report, which focused primarily on Tier 1 banks, found that hyperautomation led to time and cost savings of up to 90%, particularly for investigations and remediation. More specifically, the report discovered that implementing hyperautomation within AFC operations at banks:

- Reduced the time taken for Level 1 investigations by 90% and reduced the number of full-time employees focused on repetitive manual tasks by 75%.

- Reduced the time and people required for AFC operations by two-thirds.

- Eliminated manual data gathering, consolidation and standardization from Level 1 review, reducing the required decisions by up to 60%.

- Reduced the number of bottlenecks in the alert handling, risk and reporting stages.

- Drove efficiency beyond the AFC operations process, with cuts as high as 90% in manual data extraction and processing as part of reporting to the internal audit, policy, and risk departments.

- Created powerful analytics to enable continuous improvements in AFC.

Chartis also analyzed one Tier 1 bank as part of the research report, revealing that by automating some of its AFC operations, the bank was able to combine many key processes, including customer due diligence, transaction monitoring and anti-money laundering screening.

“Automating these work-heavy processes reduced workload by 75%, increased efficiencies in areas such as audit and risk and enhanced traditionally ‘unautomated’ areas of the AFC workflow (such as investigations),” the report stated.

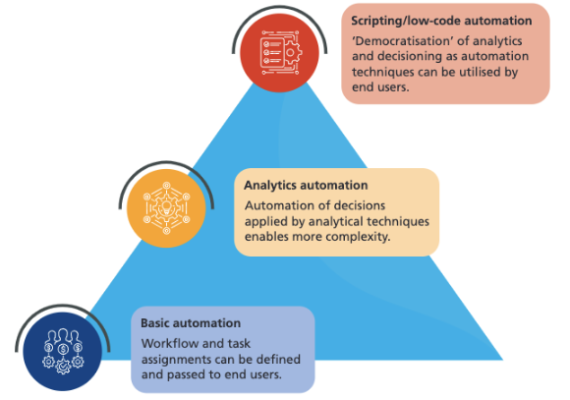

As hyperautomation has become increasingly essential to AFC operations, Chartis outlined three steps to establish effective hyperautomation based upon its research, including:

- Basic automation. Most banks are currently at this stage. The distinct automated areas are not linked, and significant manual input is still required in many processes. Individual elements (such as parts of the CDD process) are automated via workflows and data flows. Sanctions screening is also commonly automated, often with AI/ML applications at the back end to help reduce false positives and manage alerts.

- Analytics automation. By automating decisions and analytics that flow throughout the AFC architecture, banks can eliminate significant manual processes almost entirely. By applying analytics up- and downstream in the process, they can develop better rules on everything from data collection to risk parameters. At this stage, such processes as investigations can be automated effectively.

- Self-serve, no-code. By this stage, both the architecture of the AFC unit and the technology that supports it are well integrated. This frees end-users previously engaged in highly repetitive manual tasks to perform complex analytics and make decisions that align more closely with the firm’s risk policy.

Chartis Research

At Nasdaq, we strive to reduce the burden of manual processes across all anti-financial crime activities for banks around the world. Through the Nasdaq Automated Investigator for AML,an innovative technology that replicates the alert investigation processing and decisions carried out by human analysts today, financial institutions can devote more resources to the risks that matter.

Image and article originally from www.nasdaq.com. Read the original article here.