This bullish signal has rarely been wrong in the past

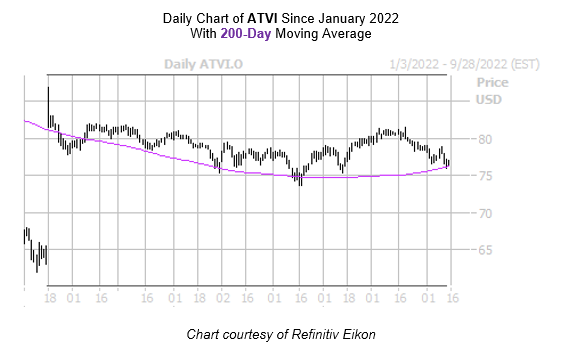

Since surging from its annual lows near the $62 level in January, the shares of Activision Blizzard Inc (NASDAQ:ATVI) has mostly traded between the $74 and $82 region. The video game concern failed to break out of this range even after Warren Buffet’s Berkshire Hathaway (BRK) increased its stake to 9.5%, and the security now sits just below its year-over-year breakeven level. However, ATVI could soon trim that deficit, as it’s just pulled back to a historically bullish trendline on the charts.

Specifically, Activision Blizzard stock just came within one standard deviation of its 200-day moving average, after spending considerable time above the trendline. According to the latest data from Schaeffer’s Senior Quantitative Analyst Rocky White, similar signals have occurred six times during the past three years, with ATVI averaging a 5.5% gain in 80% of these occurrences. Last seen up 0.6% at $77.07, a similar move from its current perch would put the equity above $81.

The brokerage bunch leans pessimistic toward the gaming stock, so a shift in sentiment could provide additional tailwinds. Currently, 10 of 17 analysts in coverage carry a “hold” rating, with one “strong sell” also on the books.

An unwinding of pessimism among options traders could push ATVI higher, too. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity sports a 10-day put/call volume ratio that stands higher than 79% of readings from the last year. This means puts have rarely been more popular.

Plus, now looks like an affordable time to speculate on the security’s next move with options. The stock’s Schaeffer’s Volatility Index (SVI) of 17% sits higher than 26% of readings in its annual range, implying options players are pricing in relatively low volatility expectations at the moment.

Image and article originally from www.schaeffersresearch.com. Read the original article here.