Here are three stocks with buy rank and strong income characteristics for investors to consider today, February 13:

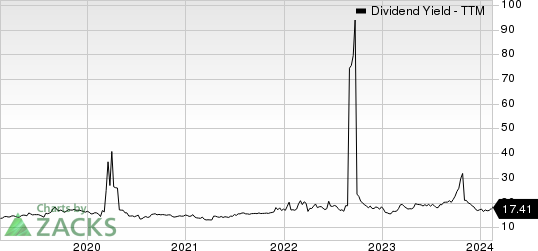

Orchid Island Capital, Inc. ORC: This finance company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 73.7% the last 60 days.

Orchid Island Capital, Inc. Price and Consensus

Orchid Island Capital, Inc. price-consensus-chart | Orchid Island Capital, Inc. Quote

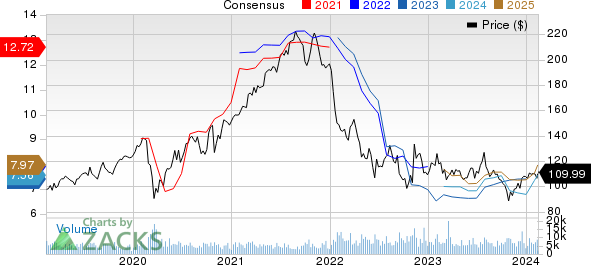

This Zacks Rank #1 company has a dividend yield of 17.5%, compared with the industry average of 0.0%.

Orchid Island Capital, Inc. Dividend Yield (TTM)

Orchid Island Capital, Inc. dividend-yield-ttm | Orchid Island Capital, Inc. Quote

Equitrans Midstream Corporation ETRN: This midstream energy company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.7% the last 60 days.

Equitrans Midstream Corporation Price and Consensus

Equitrans Midstream Corporation price-consensus-chart | Equitrans Midstream Corporation Quote

This Zacks Rank #1 company has a dividend yield of 5.9%, compared with the industry average of 2.1%.

Equitrans Midstream Corporation Dividend Yield (TTM)

Equitrans Midstream Corporation dividend-yield-ttm | Equitrans Midstream Corporation Quote

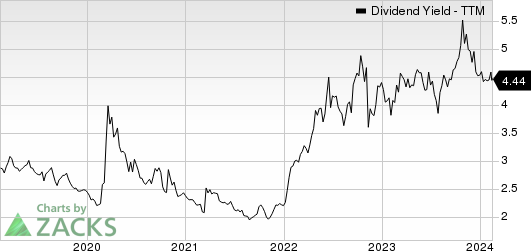

T. Rowe Price Group, Inc. TROW: This investment management company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.2% the last 60 days.

T. Rowe Price Group, Inc. Price and Consensus

T. Rowe Price Group, Inc. price-consensus-chart | T. Rowe Price Group, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 4.6%, compared with the industry average of 3.1%.

T. Rowe Price Group, Inc. Dividend Yield (TTM)

T. Rowe Price Group, Inc. dividend-yield-ttm | T. Rowe Price Group, Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Orchid Island Capital, Inc. (ORC) : Free Stock Analysis Report

Equitrans Midstream Corporation (ETRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.