Big tech has continued to prove its incredible resilience and ability to produce massive profits following the most recent earnings reports. Amazon AMZN, Meta Platforms META, and Netflix NFLX all reported impressive earnings, and all gapped up significantly following the meeting.

Furthermore, each stock enjoys a top Zacks Rank, indicating upward trending earnings revisions, and strong near-term expectations for the share price.

Although I understand some investors are hesitant to buy now or add to positions in the large cap technology stocks after they have rallied so much over the last year, but just because a stock goes up doesn’t always mean it can’t go up more.

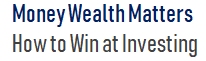

Image Source: Zacks Investment Research

These three stocks are all trading at historically fair relative valuations, so investors need not fear buying into an overvalued market. In fact, after seeing such strong growth and profitability in the most recent quarterly reports, and experiencing earnings estimates upgrades, the valuations appear even more reasonable.

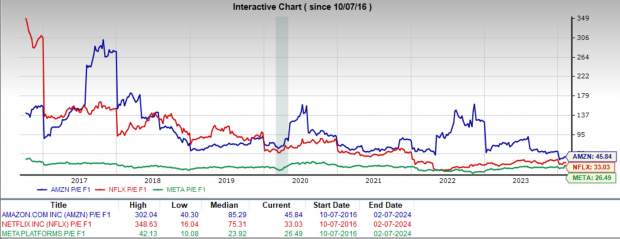

Image Source: Zacks Investment Research

Netflix

At the most recent quarterly earnings meeting Netflix beat estimates on both the top and bottom line, and recorded record subscriber growth. Netflix’s platform now has 261 million paid subscribers, adding 13 million in Q4 alone.

At the meeting, management announced a plan to expand the content offerings on the streaming platform, and just signed a deal with the WWE to show stream the Raw wrestling program weekly.

Netflix has a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. Analysts have near unanimously upgraded their earnings estimates over the last two months, with current quarter expectations rising by 10.5% to $4.41 per share and FY24 earnings climbing 6.3% to $16.93 per share.

This technical setup of NFLX stock is a prototypical post-earnings gap and bull flag and offers a high probably trade. If NFLX can trade above the $564 level, it would signal a breakout. However, if it loses support at and trades below $553, the setup is invalid, and investors may want to wait for another opportunity.

Image Source: TradingView

Meta Platforms

Meta Platforms also just shared a banner earnings report, also beating on both sales and earnings estimates. Sales in Q4 jumped 25% YoY to $40.1 billion and expenses decreased 8% YoY.

Additionally, Meta Platforms announced its first dividend payment after its cash pile expanded to $60 billion. They also announced a $50 billion share buyback program in an effort to return even more cash to shareholders.

META has a Zacks Rank #1 (Strong Buy), with analysts unanimously raising earnings estimates over the last two months and across timeframes.

Image Source: Zacks Investment Research

Like the others, META stock has formed a picture-perfect post earnings bull flag. If the stock can move above the $474 level, it would indicate a breakout. Alternatively, if it trades below the $454 level of support, it may fill that gap before moving higher again.

Image Source: TradingView

Amazon.com

Finally, the e-commerce and cloud-computing giant, Amazon looks to have everything going for it. Another quarter of beating analysts’ estimates, a booming new advertising business, and a Zacks Rank #1 (Strong Buy) rating makes AMZN stock a worthy investment to consider.

These post earnings bull flags are the theme here today, and Amazon stock is no different. If the stock moves above the $171.50 level, it signals a breakout and should send the stock swiftly higher. But below that lower bound of $168, and it may take some time for it to set up again.

Image Source: TradingView

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.