Everybody loves dividends, as they provide a passive income stream, limit drawdowns in other positions, and provide more than one way to profit from an investment.

And when considering dividend-paying stocks, those with a history of boosting their payout are prime considerations, reflecting their commitment to shareholders.

In addition, consistent dividend hikes reflect a company’s successful nature, opting to share profits with shareholders.

For those seeking companies with a history of dividend growth, three stocks – Broadcom AVGO, Caterpillar CAT, and UnitedHealth UNH – precisely fit the criteria.

Let’s take a closer look at each.

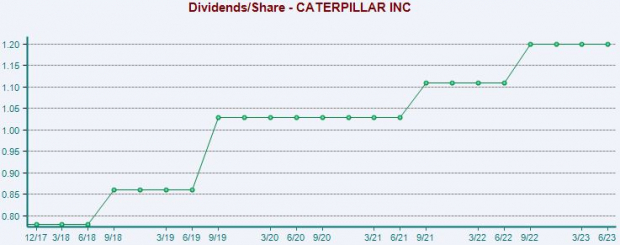

Caterpillar

Caterpillar is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.

Image Source: Zacks Investment Research

Caterpillar is a member of the elite Dividend Aristocrats club, owing to its shareholder-friendly nature. Shares currently yield 1.9% annually, with the payout growing by 7.4% annualized over the last five years.

Image Source: Zacks Investment Research

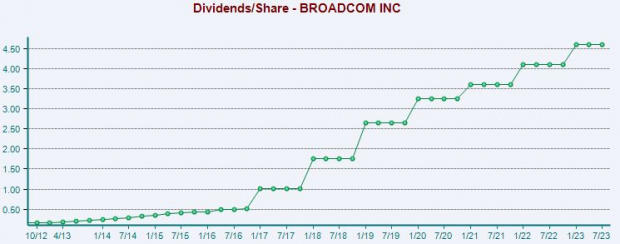

Broadcom

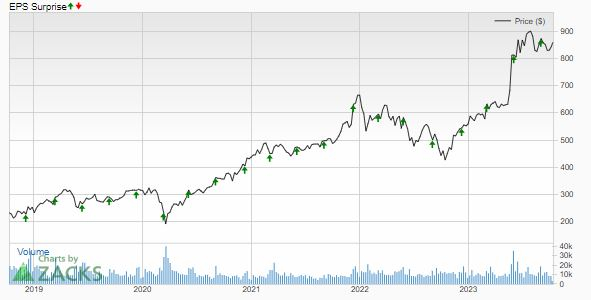

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. Shares have had a strong run in 2023, up more than 50% and widely outperforming the general market.

The company’s shares currently yield a solid 2.1% annually, well above the Zacks Computer & Technology sector average. Undoubtedly impressive, the company sports a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

In addition, the company has been the definition of consistency concerning quarterly results, exceeding Zacks Consensus EPS and Sales Estimates in 14 consecutive quarters. AVGO’s consistency is illustrated by the green arrows in the chart below.

Image Source: Zacks Investment Research

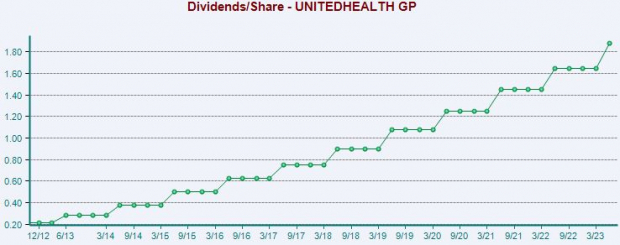

UnitedHealth

UnitedHealth provides a wide range of healthcare products and services, including health maintenance organizations (HMOs), point of service plans (POS), and preferred provider organizations (PPOs).

The company’s shareholder-friendly nature is evident by its impressive 16% five-year annualized dividend growth rate. Shares presently yield 1.4% annually paired with a payout ratio sitting at 32% of its earnings.

Image Source: Zacks Investment Research

And the company generates ample cash to keep the payments coming; UNH generated roughly $23.4 billion in free cash flow throughout its FY22, improving 17% year-over-year.

Bottom Line

Companies that consistently boost their dividend payouts reflect a successful and shareholder-friendly nature, opting to share a portion of profits with investors.

And for those seeking dividend growers, all three companies above – UnitedHealth UNH, Caterpillar CAT, and Broadcom AVGO – fit the criteria.

All three have grown their payouts nicely over the years, owing to their shareholder-friendly natures.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

Caterpillar Inc. (CAT) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.