Few things delight investors more than consistent, dependable dividend payouts.

After all, who doesn’t enjoy being compensated for their investments?

Dividends were a valuable commodity for investors in 2022, helping to cushion the impact of drawdowns in other positions.

Dividend Aristocrats, companies that have increased their dividend payouts for at least 25 consecutive years, are popular targets among income investors.

However, a step above is the elite Dividend Kings group, which includes companies that have increased dividend payouts for at least 50 consecutive years.

Three Dividend Kings – Sysco Corp. SYY, AbbVie ABBV, and PepsiCo Inc. PEP – could all be considerations for investors looking to reap a reliable income stream.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Sysco Corp.

Sysco markets and distributes a range of food and related products primarily to the food service or food-away-from-home industry.

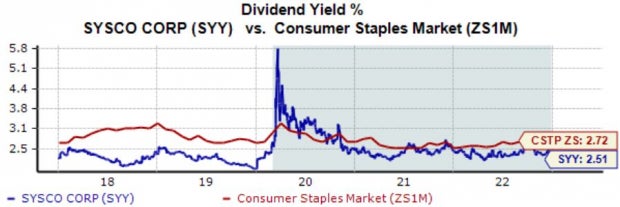

Sysco’s annual dividend currently yields a solid 2.5%, modestly below its Zacks Consumer Staples sector average. Still, the company’s 8.3% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

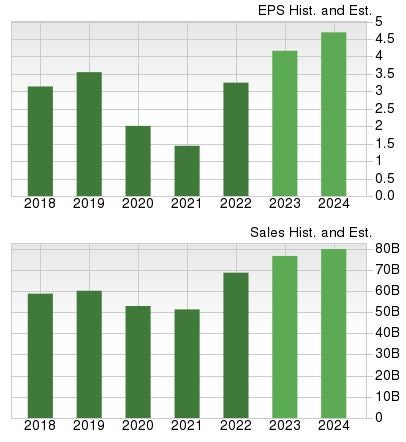

In addition, it’s hard to ignore SYY’s growth profile; earnings are forecasted to soar 28% in its current fiscal year (FY23) and a further 13% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 11.5% in FY23 and 4.2% in FY24.

Image Source: Zacks Investment Research

AbbVie

AbbVie enjoys leadership positions in key therapeutic areas, including immunology, hematologic oncology, neuroscience, aesthetics, eye care, and women’s health.

AbbVie’s 3.5% annual dividend yield is well above its Zacks Medical Sector average of 1.4%. Further, ABBV carries a sustainable 41% payout ratio paired with an impressive 14% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

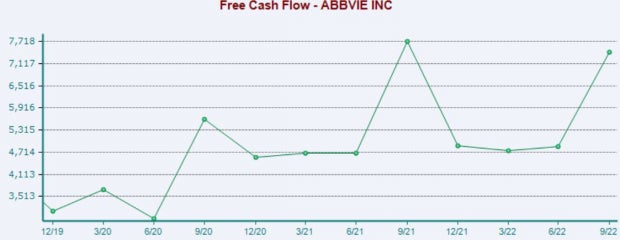

The company also generates solid cash; ABBV generated roughly $7.4 billion in free cash flow in its latest quarter, representing a 52% sequential uptick.

Image Source: Zacks Investment Research

PepsiCo Inc.

PepsiCo is a long-established company engaged in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products. Currently, the company sports a favorable Zacks Rank #2 (Buy).

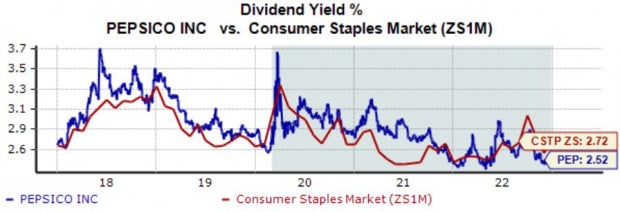

PEP’s annual dividend currently yields 2.5%, a few ticks below its Zacks Consumer Staples sector average of 2.7%. Like SYY, PepsiCo’s 6.5% five-year annualized dividend growth rate helps bridge the gap.

Image Source: Zacks Investment Research

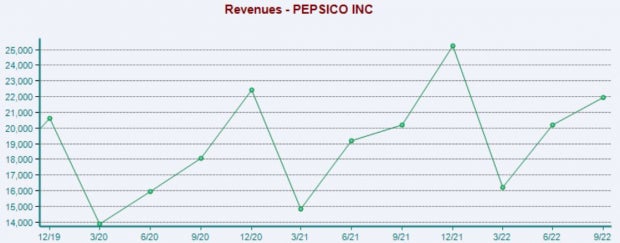

PepsiCo has been on an impressive earnings streak as of late, exceeding earnings and revenue estimates in each of its last three quarters. Just in its latest release, the company registered a 6.5% EPS beat and reported revenue 5.3% above expectations.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Dividends cushion the blow of losses in other positions, provide an additional way to earn a return on investment, and allow for maximum returns through dividend reinvestment.

Dividend Aristocrats are common targets of income-focused investors, as these companies have successfully upped their dividend payouts for a minimum of 25 consecutive years.

However, the Elite Dividend Kings group sits right above, which consists of companies increasing their payouts uninterrupted for a minimum of 50 consecutive years.

Clearly, Dividend Kings, including Sysco Corp. SYY, AbbVie ABBV, and PepsiCo Inc. PEP, have all shown an unparalleled commitment to shareholders throughout their history.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.