BlackRock, Inc.’s BLK third-quarter 2022 adjusted earnings of $9.55 per share surpassed the Zacks Consensus Estimate of $7.93. The figure reflects a decrease of 15.8% from the year-ago quarter.

Results benefited from a decline in expenses. However, lower revenues and assets under management (AUM) balance were the major headwinds.

Net income attributable to BlackRock (on a GAAP basis) was $1.41 billion, down 16.4% from the prior-year quarter.

Revenues & Expenses Decline

Revenues (on a GAAP basis) were $4.31 billion, falling 14.6% year over year. The decline largely stemmed from a decrease in almost all components of revenues, except for technology services revenues. The figure also lagged the Zacks Consensus Estimate of $4.41 billion.

Total expenses amounted to $2.79 billion, down 10.6%. The decline was due to a fall in all cost components.

Non-operating income (on a GAAP basis) was $165 million, down 5.1% from the year-ago quarter.

BlackRock’s adjusted operating income was $1.59 billion, down 21.7% from the prior-year period.

AUM Balance Dips

As of Sep 30, 2022, AUM totaled $7.96 trillion, reflecting a year-over-year fall of 15.9%. In the reported quarter, the company witnessed long-term net inflows of $65 billion. However, unfavorable market change and FX impact hurt AUM balance.

Average AUM of $8.48 trillion as of Sep 30, 2022, declined 11.5% year over year.

Share Repurchase Update

BlackRock repurchased shares worth $375 million in the reported quarter.

Our View

BLK’s continued efforts to strengthen the iShares and ETF operations, along with its initiatives to restructure the actively-managed equity business, are expected to remain tailwinds. However, the uncertain markets and extreme volatility on the back of macroeconomic concerns have led to an unfavorable operating backdrop for BlackRock.

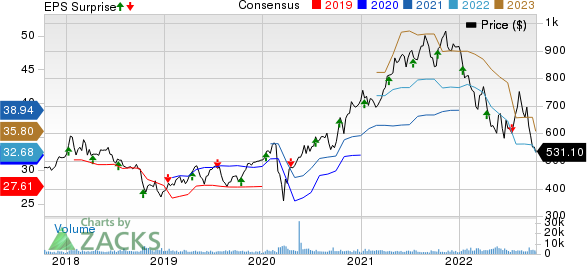

BlackRock, Inc. Price, Consensus and EPS Surprise

BlackRock, Inc. price-consensus-eps-surprise-chart | BlackRock, Inc. Quote

BlackRock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Dates & Expectations of Other Asset Managers

Invesco Ltd. IVZ is scheduled to announce third-quarter 2022 numbers on Oct 25.

Over the past month, the Zacks Consensus Estimate for IVZ’s quarterly earnings has moved 2.1% south to 46 cents, implying a 40.3% decline from the prior-year reported number.

Virtus Investment Partners, Inc. VRTS is slated to report third-quarter 2022 results on Oct 26.

Over the past 30 days, the Zacks Consensus Estimate for Virtus Investment’s quarterly earnings has moved marginally lower to $6.42. This indicates a 33.9% fall from the prior-year quarter.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Invesco Ltd. (IVZ): Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.