Among the Zacks Rank #1 (Strong Buy) list there are quite a few stocks that trade at very affordable prices.

Of course, price alone is not a reason to buy a stock, but these companies’ valuations are attractive along with rising earnings estimate revisions.

Let’s take a look at three of these affordable stocks that investors may want to consider buying at the moment.

Arcos Dorados (ARCO)

Starting the list is Arcos Dorados which operates as a franchisee of McDonald’s (MCD) in Brazil and across many parts of Latin America and the Caribbean.

Arcos stock currently trades at $7 per share and 11.8X forward earnings which is nicely below the industry average of 21.2X. Even better, Arcos stock trades well below its decade high of 162.5X and at a 51% discount to the median of 24.2X.

Plus, earnings estimate revisions have started to trend higher over the last 30 days. Arcos earnings are now expected to dip -4% this year but rebound and jump 11% in FY24 at $0.73 per share.

Image Source: Zacks Investment Research

Universal Technical Institute (UTI)

Also looking like a bargain at the moment is Universal Technical Institute, a provider of technical education training in automotive, diesel, collision repair and refinishing, motorcycle, marine, and personal watercraft technologies.

Shares of UTI trade attractively relative to its past at $6 per share and 29.9X forward earnings. This is 72% below its decade-long high of 109.4X and a 30% discount to the median of 43.1X. While Universal Technical Institute’s stock trades above the industry average of 16.2X the rising earnings estimates offer further support to the company’s P/E valuation.

To that point, fiscal 2023 earnings estimates have soared 46% over the last 30 days with FY24 EPS estimates climbing 28%.

Image Source: Zacks Investment Research

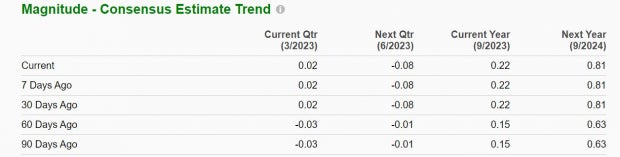

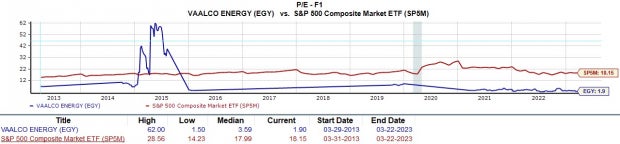

Vaalco Energy (EGY)

Rounding out the list is Vaalco Energy, a Texas based independent energy company principally engaged in the acquisition, exploration, development, and production of crude oil and natural gas.

Vaalco Energy stock trades at $4 per share and just 1.9X forward earnings which is nicely beneath the industry average of 4.8X. Furthermore, Vaalco trades 97% below its decade high of 62X and at a 45% discount to the median of 3.5X.

Even better, Vaalco’s fiscal 2023 earnings estimates have climbed 19% over the last 30 days to what would be a very impressive $2.19 per share.

Image Source: Zacks Investment Research

Takeaway

The rising earnings estimate revisions reaffirm that these affordable stocks appear to be trading at discounts when considering their attractive P/E valuations. At their current levels, much of the risk looks priced in already and there could be plenty of upside ahead.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

Universal Technical Institute Inc (UTI) : Free Stock Analysis Report

Vaalco Energy Inc (EGY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.