Numerous investment styles exist, with some investors opting for income-generating assets, while others focus on value or specific industries.

And some investors prefer a less-conservative approach, such as small-cap stocks, which sport remarkable growth potential due to being in their early stages.

For those with a preference for small-caps, three top-ranked stocks – Universal Insurance Holdings UVE, Vertex Energy VTNR, and Vera Bradley VRA – could all be considerations. Let’s take a deeper dive into each.

Universal Insurance Holdings

Universal Insurance Holdings is a leading holding company of property and casualty insurance and value-added insurance services. As we can see below, UVE’s earnings outlook has turned visibly bright over the last 60 days.

Image Source: Zacks Investment Research

It’s hard to ignore the company’s growth trajectory; the Zacks Consensus EPS Estimate of $1.65 suggests an improvement of more than 500% year-over-year. And in FY24, earnings are forecasted to climb a further 45%.

UVE posted strong quarterly results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 350% and registering a 4% revenue surprise. Investors cheered on the results, sending UVE shares soaring post-earnings.

Image Source: Zacks Investment Research

Vertex Energy

Vertex Energy is an environmental services company recycling industrial waste streams and off-specification commercial chemical products. Analysts have taken a bullish stance on the company’s bottom line outlook, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Like UVE, Vertex Energy boasts an impressive growth profile, with earnings forecasted to soar a mind-boggling 900% in its current fiscal year. And in FY24, earnings are forecasted to improve a further 50%.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 30% in FY23 and 20% in FY24.

In addition, the company sports a 94.3% trailing twelve-month return on equity (ROE), indicating a notably higher level of generating profits from existing assets relative to the Zacks Industrial Products sector average.

Image Source: Zacks Investment Research

Vera Bradley

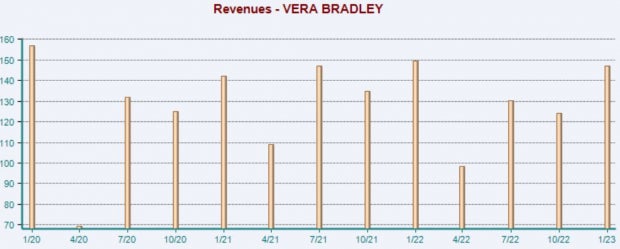

Vera Bradley Designs is a designer, producer, marketer, and retailer of accessories for women. Its products include handbags, accessories, and travel and leisure items. Currently, VRA is a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

VRA has posted strong quarterly results as of late, exceeding both earnings and revenue expectations in back-to-back releases. Just in its latest print, Vera Bradley posted a 6.6% EPS beat and reported revenue 7% above expectations.

Image Source: Zacks Investment Research

Bottom Line

For investors who favor a less conservative approach by targeting small-cap stocks, all three above – Universal Insurance Holdings UVE, Vertex Energy VTNR, and Vera Bradley VRA – are three top-ranked options worth considering.

While this approach may be less conservative, it can lead to significant returns for those willing to take on the additional risk. Don’t we all want in early on the next big thing?

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

Vera Bradley, Inc. (VRA) : Free Stock Analysis Report

Vertex Energy, Inc (VTNR) : Free Stock Analysis Report

UNIVERSAL INSURANCE HOLDINGS INC (UVE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.