Large-cap stocks are frequently targeted among investors. They typically have greater stability and a proven track record, two reasons why they’re beloved.

They also frequently pay dividends, providing another advantage for those seeking exposure. Large caps typically aren’t as explosive as small-cap stocks, being tailored toward more conservative investors.

Still, many large-caps carry favorable growth expectations, including Cadence Design CDNS, Broadcom AVGO, and Arista Networks ANET.

All three carry a favorable Zacks Rank, reflecting upward earnings estimate revisions among analysts.

In addition, all three provide exposure to technology, whose performance as a sector has been remarkable in 2023. Let’s take a closer look at each.

Cadence Design Systems

Cadence Design Systems, a current Zacks Rank #2 (Buy), offers products and tools that help customers design electronic products. The revisions trend has been particularly noteworthy for its current fiscal year, with the EPS estimate up 13% since December of last year.

Image Source: Zacks Investment Research

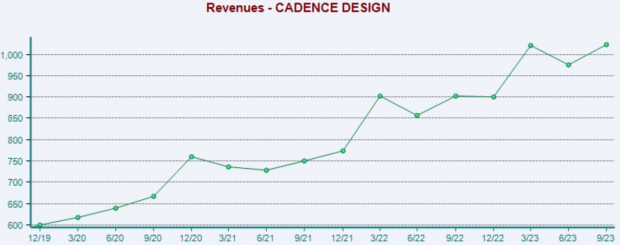

The company’s forecasted growth is hard to dismiss, with consensus estimates for its current year suggesting 20% earnings growth on 15% higher sales. And peeking ahead to FY24, estimates allude to an additional 14% uptick in earnings paired with 11% higher sales.

It’s worth noting that Cadence Design has been a stellar earnings performer, exceeding consensus EPS and revenue estimates in each of its last ten quarters. Just in its latest release, CDNS posted a 4% EPS beat and reported revenue 2% ahead of expectations.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Broadcom

Broadcom, a current Zacks Rank #2 (Buy), is a premier designer, developer, and global supplier of a broad range of semiconductor devices.

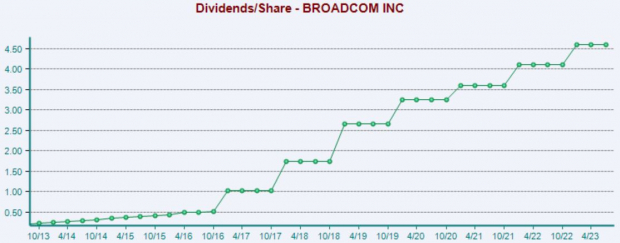

Broadcom has shown a notable commitment to increasingly rewarding shareholders, boasting a sizable 16.6% five-year annualized dividend growth rate. AVGO shares currently yield a solid 1.9% annually, nicely above the Zacks Computer and Technology sector average of 0.7%.

Image Source: Zacks Investment Research

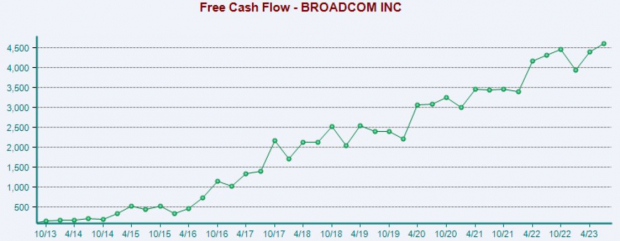

The company’s payout has been protected by impressive cash-generating abilities. AVGO generated roughly $16.3 billion in free cash flow throughout its FY22, improving 22% on a year-over-year basis.

Image Source: Zacks Investment Research

Broadcom’s earnings are forecasted to climb 12% in its current year (FY23) on 8% higher sales, with FY24 consensus estimates suggesting 9% earnings growth paired with a 7% revenue bump.

Arista Networks

Arista Networks shares have benefited nicely from the AI frenzy in 2023, up more than 70% year-to-date and widely outperforming relative to the S&P 500. The company provides network switches to hyperscalers that speed up communication between computer servers.

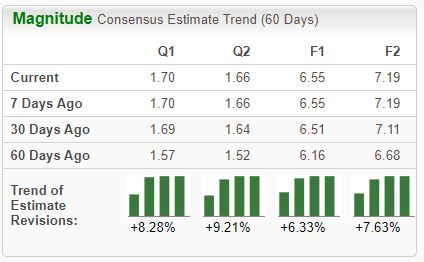

The stock is a Zacks Rank #1 (Strong Buy), with expectations moving higher across all timeframes.

Image Source: Zacks Investment Research

The company boasts the most impressive growth profile of the bunch, with consensus estimates for its current fiscal year suggesting 43% earnings growth on 33% higher sales. Growth looks to continue in FY24, as estimates allude to an additional 10% boost in earnings paired with an 11% revenue climb.

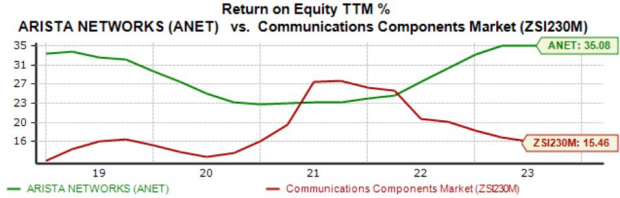

Further, ANET’s 35.1% trailing twelve-month return on equity (ROE) is worth highlighting, reflecting a higher efficiency level in generating profits from existing assets relative to the respective Zacks Communication – Components industry average.

Image Source: Zacks Investment Research

Bottom Line

Large caps are found in nearly every portfolio, as their stable nature and successful track records are impossible to ignore.

And for those seeking large-cap exposure, all three stocks above – Cadence Design CDNS, Broadcom AVGO, and Arista Networks ANET – could be great considerations, all boasting improved earnings outlooks.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.