Amid times of uncertainty and increased volatility, investors stand to benefit from blending a layer of defense into their portfolios.

After all, defense wins ballgames.

Stocks in the Zacks Consumer Staples sector carry a defensive nature, as these companies’ products have an advantageous ability to generate consistent demand in the face of many economic situations.

Three top-ranked stocks from the realm – PepsiCo PEP, Monster Beverage MNST, and Procter & Gamble PG – could all be considerations for investors looking to heighten their portfolio’s defense.

Below is a chart illustrating the performance of all three stocks over the past year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have outperformed the S&P 500, putting their defensive nature on full display. Let’s take a closer look at each one.

PepsiCo

PepsiCo is a long-established company engaged in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products. We see their items on nearly every shelf. Currently, the company sports a Zacks Rank #2 (Buy).

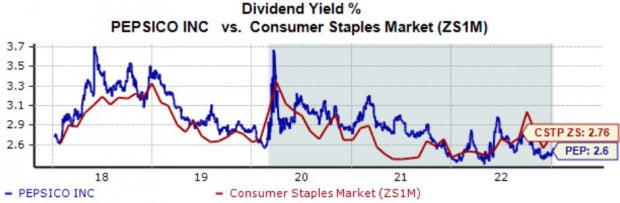

A significant positive, PepsiCo belongs to the elite Dividend Kings group, showing an unparalleled commitment to its shareholders through 50+ years of increased payouts.

Currently, the company’s annual dividend yields 2.6%.

Image Source: Zacks Investment Research

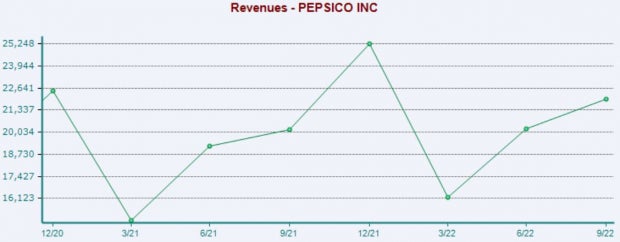

PepsiCo has consistently posted better-than-expected results as of late, exceeding earnings and revenue estimates in each of its last three quarters.

Just in its latest release, PEP registered a 6.5% EPS beat and reported revenue 5.3% above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Monster Beverage

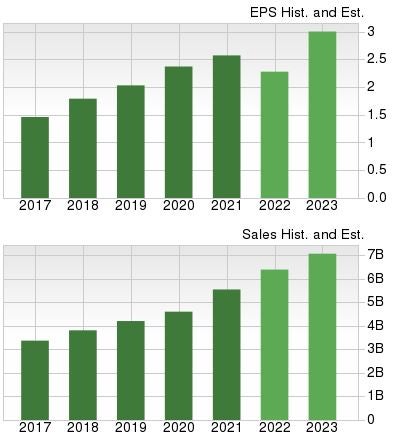

Monster Beverage is a marketer and distributor of energy drinks and other alternative beverages. The company has seen its earnings outlook improve over the last several months, helping push the stock into a Zacks Rank #2 (Buy).

The company’s earnings are forecasted to take a hit in its current fiscal year (FY22), with estimates indicating an 11% Y/Y pullback. Still, the growth picks back up in FY23, with estimates calling for 30% earnings growth.

Image Source: Zacks Investment Research

In addition, MNST shares have been big-time outperformers over the last three years, up more than 60% compared to the S&P 500’s roughly 24% gain.

Image Source: Zacks Investment Research

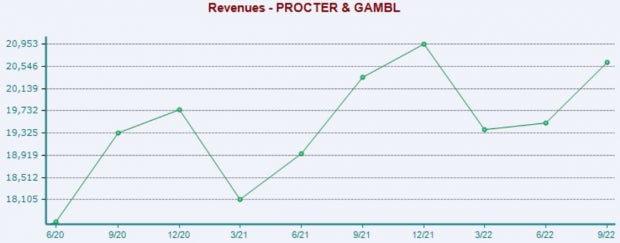

Procter & Gamble

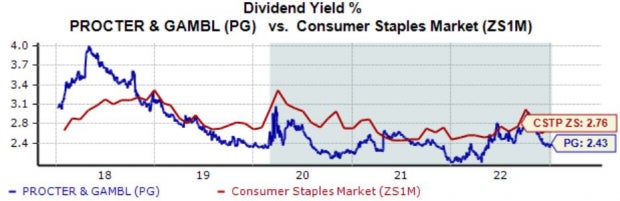

Procter & Gamble is a branded consumer products company that markets its products in more than 180 countries. Like the stocks above, PG’s earnings outlook has recently improved, pushing the stock into a Zacks Rank #2 (Buy).

For those seeking income, PG’s got that covered; the company’s annual dividend currently yields a solid 2.4%, a few ticks below its Zacks Consumer Staples sector average.

Still, the company’s 6.4% five-year annualized dividend growth rate helps to bridge the gap.

Image Source: Zacks Investment Research

Similar to PEP, Procter & Gamble has consistently exceeded quarterly estimates, penciling in nine EPS beats across its last ten quarters. In the last reported quarter, the company registered a 1.3% earnings beat and reported revenue modestly above expectations.

Image Source: Zacks Investment Research

Bottom Line

Adding Consumer Staples stocks is a way that investors can heighten their portfolio’s defense, as these companies’ products generate reliable and consistent demand in the face of many economic situations.

In addition, many of these stocks pay dividends, undoubtedly a significant boost.

For those looking to shield themselves against volatility, all three stocks above – PepsiCo PEP, Monster Beverage MNST, and Procter & Gamble PG – could be of interest.

All three have seen their near-term earnings outlooks improve as of late, a major positive.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Procter & Gamble Company The (PG) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.