The broader Zacks Business Services sector continues to stand out this earnings season with booming industries such as the Zacks Technology Services Industry,

With the demand for technology and digitalization continuing to transform business services here are three top-rated Zacks Technology Services Industry stocks to buy after strong quarterly results on Wednesday.

AppLovin APP

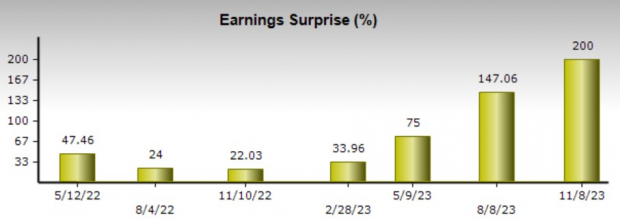

Currently sporting a Zacks Rank #2 (Buy) the price performance of AppLovin’s stock has caught the attention of many investors this year with APP shares up +278% in 2023.

Providing a technology platform that allows developers to publish apps the company’s third-quarter results helped justify the hype. Earnings of $0.30 per share beat estimates by 11% and soared from $0.06 a share in the prior-year quarter. On the top line, sales of $864.26 million came in 9% above estimates of $794.43 million and rose 21% from $713.10 million in Q3 2022.

Image Source: Zacks Investment Research

LiveRamp RAMP

Also sporting a Zacks Rank #2 (Buy) LiveRamp’s stock looks attractive after its fiscal second quarter results on Wednesday. LiveRamp is a marketing technology company that provides data foundation, digital transformation, and consumer engagement along with online marketing and analysis services.

LiveRamp’s Q2 earnings of $0.43 per share came in 59% above estimates of $0.27 a share. More impressive, earnings soared 95% from $0.22 a share in the prior year quarter with Q2 sales of $159.87 million surpassing expectations by 5% and rising 8% year over year.

LiveRamp’s stock popped +20% on Thursday and is now up +53% in 2023 having surpassed earnings expectations in three of its last four quarterly reports while posting an average earnings surprise of 38%,

Image Source: Zacks Investment Research

Duolingo DUOL

Last but not least, Duolingo’s stock boasts a Zacks Rank #1 (Strong Buy) and spiked +21% today with a number of analysts boosting their price targets after favorable Q3 results on Wednesday. Duolingo provides a mobile language learning platform that is increasing in popularity with DUOL shares now up +185% this year.

Reassuringly, Duolingo posted a surprise earnings profit of $0.06 per share compared to estimates that called for an adjusted loss of -$0.06 a share. More importantly, earnings climbed from an adjusted loss of -$0.46 a share in Q3 2022. Quarterly sales of $137.62 million comfortably topped estimates by 5% and were up 8% from $96.07 million a year ago. Furthermore, Duolingo has now surpassed earnings expectations for eight consecutive quarters.

Image Source: Zacks Investment Research

Bottom Line

These innovative technology services companies continued to reconfirm their attractive growth trajectories with impressive quarterly results and now looks like a good time to invest in AppLovin, LiveRamp, and Duolingo.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

AppLovin Corporation (APP) : Free Stock Analysis Report

LiveRamp Holdings, Inc. (RAMP) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.