Investors who target stocks displaying relative strength often find themselves in favorable trends, no matter the direction of the general market.

For a quick explanation, relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

Three stocks – Dick’s Sporting Goods DKS, Meta Platforms META, and Sea Limited SE – could all be considerations for investors looking to tap into relative strength.

All three have stolen the show in March so far, up more than 10% and widely outperforming the S&P 500. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Meta Platforms

Meta has intensely focused on cost-cutting measures, with recent layoff announcements and expense cuts helping pump life into shares. Currently, META sports a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

META shares have gotten much cheaper following a harsh 2022, with the company’s 20.1X forward earnings multiple sitting well beneath the 23.4X median and the Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

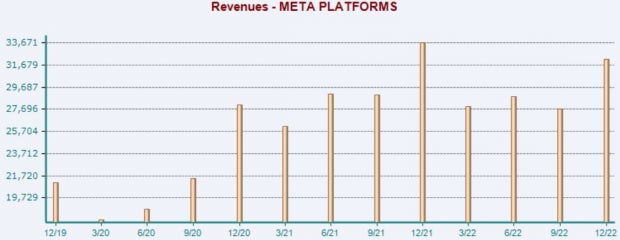

Meta Platforms posted a monster quarter in its latest release, exceeding bottom line expectations by more than 40% and delivering a 3% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

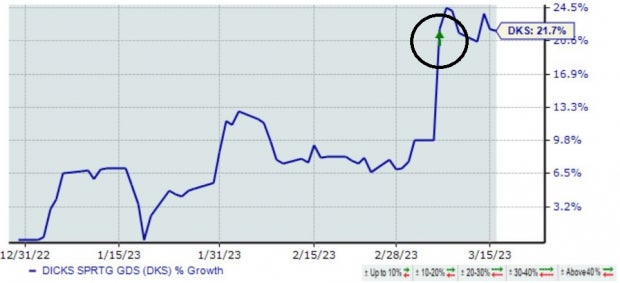

Dick’s Sporting Goods

Dick’s Sporting Goodsis a significant omnichannel sporting goods retailer, offering athletic shoes, apparel, accessories, and a broad selection of outdoor and athletic equipment. DKS is currently a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Dick’s Sporting Goods posted strong results in its latest release, penciling in a 3% EPS beat and a 5.5% revenue surprise. The market took the better-than-expected results in stride, sending shares soaring.

Image Source: Zacks Investment Research

Sea Limited

Sea Limited, an internet service provider company, offers Digital Entertainment, E-Commerce, and Digital Financial Services known as Garena, Shopee, and AirPay. Like DKS, Sea Limited carries a favorable Zacks Rank #1 (Strong Buy).

Impressively, in its latest release, SE exceeded the Zacks Consensus EPS Estimate by more than 250% and posted revenue modestly ahead of expectations.

It’s worth noting that this recent double-beat snapped a streak of negative surprises.

Image Source: Zacks Investment Research

Bottom Line

Focusing on stocks displaying relative strength is a great way for investors to find themselves in positive trends.

And in March, all three stocks above – Dick’s Sporting Goods DKS, Meta Platforms META, and Sea Limited SE – have displayed immense relative strength, outperforming the general market by notable margins.

In addition, all three sport a favorable Zacks Rank, indicating that they’ve enjoyed positive earnings estimate revisions.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

DICK’S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.