Price targets can be helpful for investors, as they can facilitate a more structured trade with pre-determined exit levels. Of course, it’s important to remember that not all stocks reach analysts’ forecasted levels.

Price targets are based on a variety of factors, including the company’s financial performance, industry trends, and overall market conditions.

And recently, three stocks – Kellogg’s K, Philip Morris International PM, and Ulta Beauty ULTA – have all seen favorable upgrades from analysts. Let’s take a closer look at how all three currently stack up.

Kellogg’s

Kellogg’s manufactures and markets ready-to-eat cereals and convenience foods, carrying a balanced portfolio of products. The stock has seen positive earnings estimate revisions, helping land it into a favorable Zacks Rank #2 (Buy). Bernstein upgraded K shares to Market Perform from Underperform with a price target of $62 per share.

The company posted strong results in its latest release, exceeding our consensus EPS estimate by 10% and delivering a positive 2.4% revenue surprise. Kellogg’s revenue growth has remained stable, further reflected in the chart below.

Image Source: Zacks Investment Research

In addition, K shares provide a solid income stream; shares currently yield a solid 3.6% annually, well above the Zacks Consumer Staples sector average. The company has continued to increasingly reward its shareholders throughout the years, as we can see in the chart below.

Image Source: Zacks Investment Research

Philip Morris International

Philip Morris International is a leading international tobacco company working to deliver a smoke-free future, evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector. Citi upgraded PM shares from Neutral to Buy with a new price target of $117 per share.

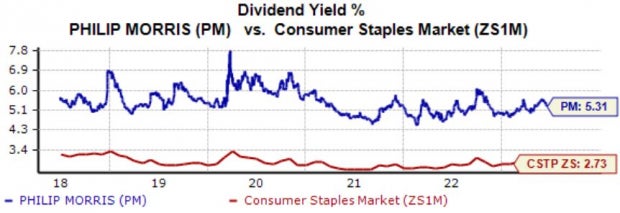

Like Kellogg’s, Philip Morris rewards its shareholders handsomely; the company’s annual dividend presently yields a sizable 5.3%, with the payout growing by nearly 3% over the last five years.

Image Source: Zacks Investment Research

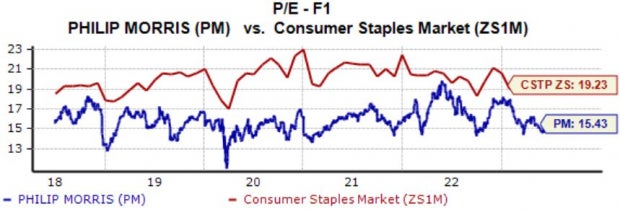

In addition, shares don’t appear stretched regarding valuation, with the current 15.4X forward earnings multiple sitting in line with the five-year median and well below the Zacks Consumer Staples sector average.

Image Source: Zacks Investment Research

Ulta Beauty

Ulta Beauty is a leading beauty retailer in the United States, with a vast product catalog that includes cosmetics, fragrances, skincare, hair care, bath and body products, salon styling tools, and more. Loop Capital upgraded ULTA shares to Buy from Hold with a $520 per share price target.

The company’s 65.6% trailing twelve-month return on equity is undoubtedly worth highlighting, reflecting higher efficiency in generating profits from existing assets relative to peers.

Image Source: Zacks Investment Research

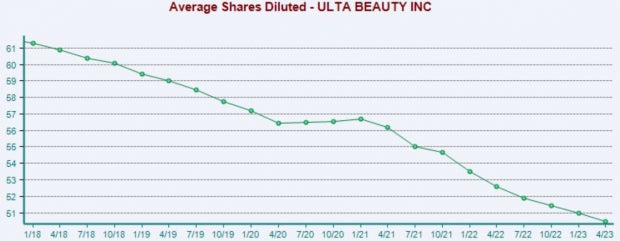

Further, the company continues to repurchase its shares aggressively, reflecting a shareholder-friendly nature. As of April 29th, ULTA had $816.5 million remaining available under the initial $2.0 billion repurchase program unveiled in 2022.

Image Source: Zacks Investment Research

Bottom Line

Price targets can help investors structure a trade, as they reflect current sentiment around the stock. Of course, it’s critical to remember that not all stocks reach analysts’ forecasted levels.

And recently, all three stocks above – Kellogg’s K, Philip Morris International PM, and Ulta Beauty ULTA – have received favorable upgrades from analysts.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.