Investors love dividends, as they provide a passive income stream and help cushion the impact of drawdowns in other positions.

And when seeking income, many investors turn to the Dividend Aristocrats, a group of companies that have upped their dividend payouts for a minimum of 25 consecutive years.

However, a step above is the elite Dividend Kings group, companies that have increased their dividend payouts for a minimum of 50 consecutive years.

Interestingly enough, several companies are gearing up to burst into the elite Dividend Kings club.

Automatic Data Processing ADP, McDonald’s MCD, and Walgreens Boot Alliance WBA are all just a few years away from becoming Dividend Kings. Below is a chart illustrating the performance of all three over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

McDonald’s

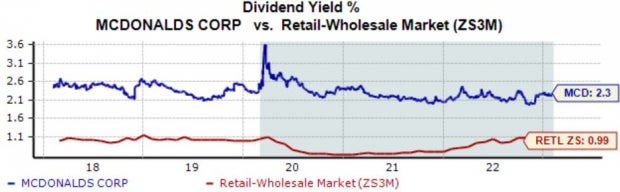

We’re all familiar with the restaurant titan McDonald’s, seeing those golden arches at seemingly every stop. The company has upped its dividend payout for 46 consecutive years.

MCD’s annual dividend currently yields a respectable 2.3%, nicely above its Zacks Retail and Wholesale sector average. Just over the last five years, the company’s payout has grown by more than 7%.

Image Source: Zacks Investment Research

In addition, the company’s earnings outlook has drifted higher across all timeframes over the last 60 days.

Image Source: Zacks Investment Research

Automatic Data Processing

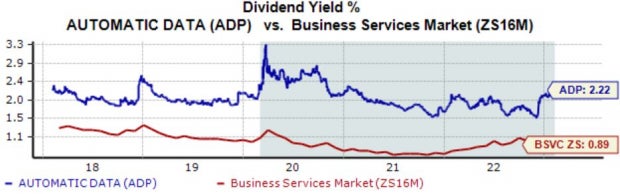

Automatic Data Processing is one of the leading providers of cloud-based Human Capital Management (HCM) technology solutions. ADP has increased its dividend payout for 48 consecutive years.

As we can see in the chart below, ADP’s 2.2% annual dividend yield handily beats out the Zacks Business Services sector average. Impressively, the company’s payout has grown by a double-digit 11% over the last five years.

Image Source: Zacks Investment Research

Further, ADP has a remarkable earnings track record; the company has exceeded both earnings and revenue expectations in 11 consecutive quarters.

In its latest release, ADP delivered a double-beat, modestly exceeding earnings and revenue estimates. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Walgreens Boot Alliance

Walgreens Boots Alliance operates as a retail drugstore chain, selling prescription and non-prescription drugs as well as general merchandise products. The company has increased its dividend payout for 47 consecutive years.

WBA’s annual dividend stands tall at 5.2%, crushing the Zacks Retail and Wholesale sector average of 1%. In addition, the company’s 43% payout ratio is sustainable, undoubtedly a major positive.

Image Source: Zacks Investment Research

And for the cherry on top, WBA shares aren’t expensive; the company’s shares currently trade at an 8.2X forward earnings multiple, below the 9.4X five-year median and a fraction of the Zacks sector average.

Walgreens sports a Style Score of “A” for Value.

Image Source: Zacks Investment Research

Bottom Line

Let’s face it – getting paid is an incredible feeling, especially when the payouts stem from your investments.

And when considering building a passive income stream, many investors turn to the Dividend Aristocrats.

However, a step above is the Elite Dividend Kings group, those that have increased their payout uninterrupted for a minimum of 50 consecutive years.

All three stocks above – Automatic Data Processing ADP, McDonald’s MCD, and Walgreens Boot Alliance WBA – are just a few years away from becoming Dividend Kings.

In addition, all three are low-beta, providing a buffer to the market’s volatility.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It’s undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don’t? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don’t miss your chance to access it for free with no obligation.

>>Show me how I could profit from the metaverse!

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.