Investors closely monitor insider buys.

It’s easy to understand why; if an insider buys, it can deliver a positive message to shareholders, indicating that they’re confident in the long-term picture of the business.

But who are insiders?

An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.

Many strict rules apply to insiders.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.

In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.

Three companies – Walgreens Boots Alliance WBA, FedEx FDX, and Casey’s General Stores CASY – have all seen recent insider activity. For those interested in insider activity, let’s take a closer look at each.

Casey’s General Stores

Casey’s General Stores operates convenience stores under the Casey’s and Casey’s General Store names in many midwestern states. A director recently purchased 725 CASY shares, with the transaction totaling nearly $200k.

The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.

Image Source: Zacks Investment Research

Investors stand to reap a steady income from CASY shares, currently yielding 0.6% annually. While it’s not a steep yield, the company’s 7% five-year annualized dividend growth rate reflects its commitment to increasingly rewarding shareholders.

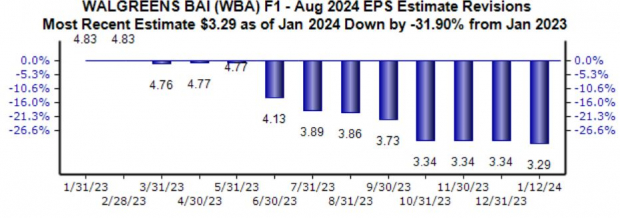

Walgreen Boots Alliance

Walgreens Boots Alliance operates as a retail drugstore chain. The company sells prescription and non-prescription drugs, as well as general merchandise products, including household items, convenience and fresh foods, personal care, beauty care, photofinishing, and candy.

The CEO recently made a big splash, acquiring 10,000 shares at a total transaction value of just under $250k. Still, it’s worth noting that analysts have taken their current year expectations well lower since last October, with the current $3.29 Zacks Consensus EPS Estimate down 32% during the period.

Image Source: Zacks Investment Research

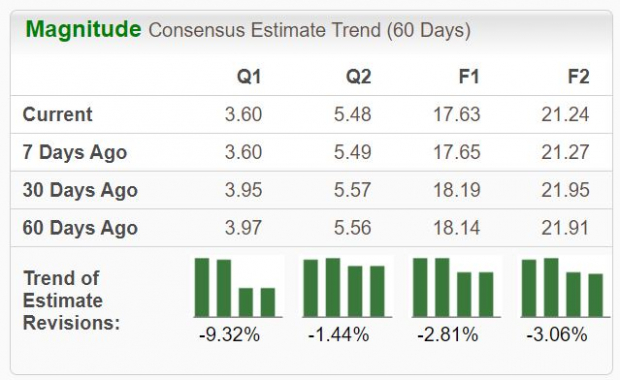

FedEx

FedEx provides an extensive portfolio of transportation, e-commerce, and business services through companies competing collectively, operating independently, and managed collaboratively under the FedEx brand.

A director recently purchased 200 shares, with the total transaction totaling $50k. FedEx’s earnings outlook has suffered a fate similar to that of WBA, with expectations moving lower across all timeframes.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?

And all three stocks above – Walgreens Boots Alliance WBA, FedEx FDX, and Casey’s General Stores CASY – have seen recent insider activity.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

FedEx Corporation (FDX) : Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.