Who doesn’t enjoy earnings season? The period is undeniably hectic for market participants, but that’s just the nature of the game.

And although the schedule is fully packed for some time, several quarterly reports slated to come, including those from Shopify SHOP, Lyft LYFT, and DraftKings DKNG, can’t be missed by investors who target growth stocks.

Growth stocks typically have higher-than-average earnings growth rates and carry high valuations, as the latter is based on future expectations.

Below is a chart illustrating the year-to-date performance of all three stocks above, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, DraftKings shares have been notably strong year-to-date, reflecting the snowballing demand within sports and online gambling. Conversely, Lyft shares are the only out of the bunch not to outperform the S&P 500.

How does each stack up heading into earnings?

Lyft

Lyft will unveil its quarterly results on Thursday, May 4th, after the market’s close. We received positive results today from a peer, Uber Technologies UBER.

Regarding Uber, the company posted a quarterly loss of -$0.08 per share, reflecting a positive 20% EPS surprise. Further, quarterly revenue totaled $8.8 billion, improving a solid 28% from the year-ago quarter.

Gross Bookings for Uber grew 19% year-over-year to $31.4 billion, with Trips also seeing strong growth, improving 24% from the year-ago quarter to 24 million daily trips per day on average. The market was impressed with Uber’s results, with shares climbing in the pre-market.

Regarding Lyft, the Zacks Consensus EPS Estimate of -$0.10 has remained unchanged over the last 60 days, with the value reflecting a decline within earnings year-over-year.

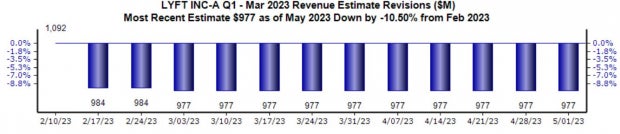

In addition, Lyft is expected to have generated roughly $977 million in revenue, with the estimate reflecting year-over-year growth of 11.5% but being revised 10% lower since February.

Image Source: Zacks Investment Research

DraftKings

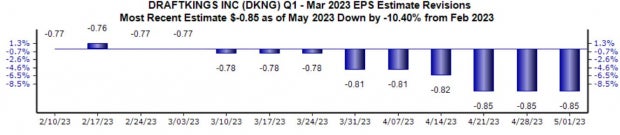

DraftKings is slated to reveal its Q1 earnings on Thursday, May 4th, after the market’s close. Analysts haven’t been particularly optimistic regarding the quarter to be reported, with the -$0.85 per share loss estimate being revised roughly 10% lower since February.

Image Source: Zacks Investment Research

However, the top line has seen some positive action from analysts, with the $700 million quarterly revenue estimate up more than 6% from the early February estimate of $656 million. Impressively, the $700 million quarterly estimate indicates a jump of roughly 68% from the year-ago quarter.

Image Source: Zacks Investment Research

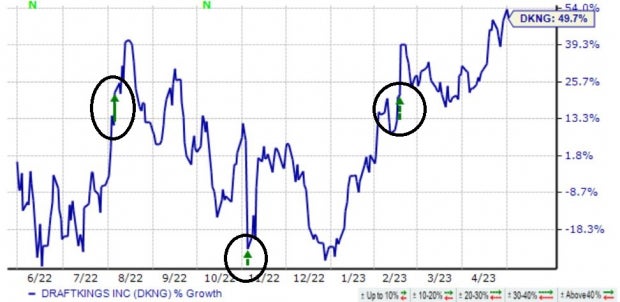

DraftKings has been a consistent earnings performer, exceeding earnings and revenue expectations in each of its last five quarters. In fact, the four-quarter trailing average EPS surprise works out to a solid 17.5%.

And as we can see in the chart below, the market has primarily had positive reactions post-earnings, with shares regularly getting a boost.

Image Source: Zacks Investment Research

Shopify

Shopify, an investor favorite during the pandemic, will reveal its quarterly results on Thursday, May 4th, after the market’s close. The company’s earnings outlook has shifted lower since February, with the -$0.04 per share loss estimate being revised downward from -$0.01 per share.

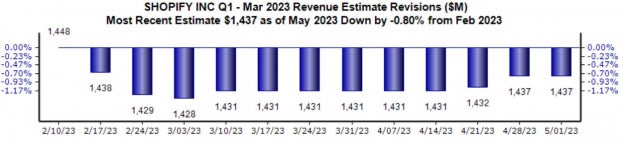

The company’s top line expectations have been tapered marginally, with our $1.4 billion consensus quarterly estimate down 0.8% since February.

Image Source: Zacks Investment Research

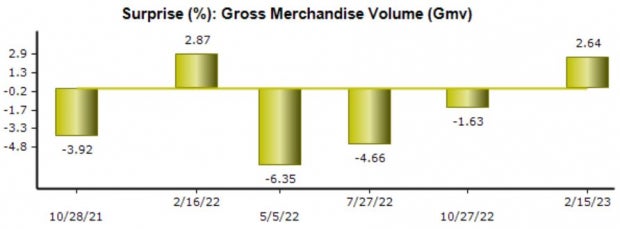

The company’s Gross Merchandising Volume (GMV) will be a closely watched metric in the release, telling us if consumers continue to find the e-commerce platform attractive. For the quarter, the Zacks Consensus Estimate for GMV stands at $47.4 billion, implying an improvement of 10% year-over-year.

As we can see in the chart below, Shopify exceeded our expectations for GMV in its latest release, snapping a streak of negative surprises.

Image Source: Zacks Investment Research

Bottom Line

Several growth stocks are slated to report this week, including Shopify SHOP, Lyft LYFT, and DraftKings DKNG.

SHOP and DKNG shares have been strong performers in 2023, outperforming the S&P 500 handily. On the flip side, LYFT shares have primarily struggled, residing in the red year-to-date.

All stocks presently carry a Zacks Rank #3 (Hold).

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Shopify Inc. (SHOP) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.