Stock buybacks, also referred to as share repurchases, are commonly used by companies to boost shareholder value.

A stock buyback occurs when a company elects to purchase outstanding shares of its stock, essentially re-investing in itself.

There are several reasons buybacks can occur – companies have decided to utilize excess cash, want to limit dilution caused by employee stock option programs, or simply because they believe their shares are undervalued.

Three companies have recently announced new stock buyback programs, including Visa V, Walmart WMT, and United Rentals, Inc. URI.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Walmart

Walmart’s product offerings include almost everything from grocery to cosmetics, electronics to stationery, home furnishings to health and wellness products, and apparel to entertainment products, to name a few.

The company has witnessed positive earnings estimate revisions over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

In its latest earnings release (Q3), WMT approved a new $20 billion share repurchase authorization, replacing its existing authorization that had approximately $1.9 billion remaining at the end of the quarter.

The company has managed to string together better-than-expected results in a harsh backdrop, exceeding earnings and revenue estimates in back-to-back quarters.

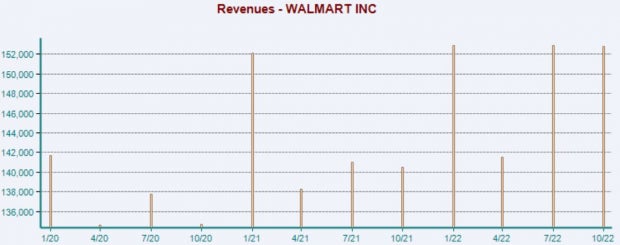

In its Q3, WMT delivered a 13% bottom-line beat paired with a 3.7% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Visa

A multinational financial services company, Visa facilitates electronic funds transfers through Visa-branded debit, credit, and prepaid cards.

In Visa’s latest earnings release (Q4), the company authorized a new $12 billion share repurchase program and raised its quarterly cash dividend by 20% to $0.45 per share.

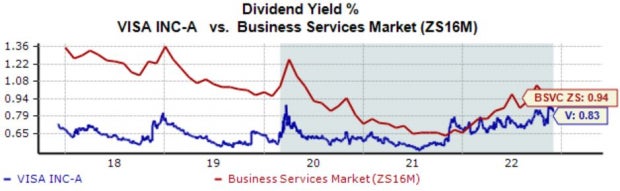

The company’s annual dividend currently yields 0.8%, just a tick below its Zacks Business Services sector average. Still, the company’s 15% five-year annualized dividend growth rate is undoubtedly strong.

Image Source: Zacks Investment Research

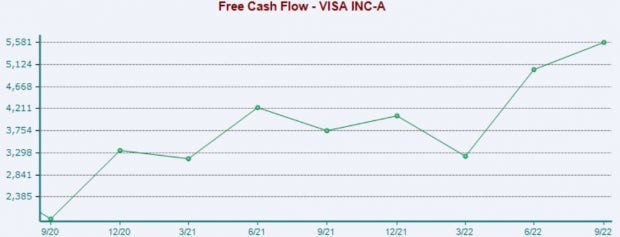

It’s hard to ignore V’s free cash flow strength; in its Q4, the company reported free cash flow of $5.6 billion, reflecting a nearly 50% Y/Y uptick.

Image Source: Zacks Investment Research

United Rentals

United Rentals, Inc. is the largest equipment rental company in the world, with an integrated network of rental locations in the United States, Canada, and Europe.

Like WMT, United Rentals has seen its near-term earnings outlook turn positive over the last several months, landing the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

United Rentals unveiled a new $1.25 billion share repurchase program in its latest earnings release (Q3), following the company’s prior $1 billion share buyback that was completed.

Further, URI doesn’t carry stretched valuation multiples; the company’s shares currently trade at a 10.9X forward earnings multiple, a few ticks above its 10.6X five-year median and below its Zacks Construction sector average.

Image Source: Zacks Investment Research

URI sports a Style Score of “A” for Value.

Bottom Line

A common way that companies can boost shareholder value is through share buybacks. In its simplest form, the company is essentially re-investing in itself.

In addition, it can provide a nice confidence boost for investors, with the buybacks indicating that the company is utilizing its excess cash and not just hoarding it.

And in the face of a challenging economic backdrop in 2022, companies willing to dish out extra cash can be hard to find.

All three stocks above – Visa V, Walmart WMT, and United Rentals, Inc. URI – have all unveiled new repurchase programs as of late in an attempt to maximize shareholder value.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Visa Inc. (V) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.