Stock buybacks, also known as share repurchase programs, are commonly implemented by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock, essentially re-investing in itself.

There are several reasons companies elect to buy back their stock; companies have decided to utilize excess cash, want to limit dilution caused by employee stock option programs, or simply because they believe their shares are undervalued.

Three companies – Kellogg Company K, Waste Management WM, and Raytheon Technologies RTX – have all recently unveiled repurchase programs.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

In addition to boosting shareholder value, all three companies have seen their shares widely outperform the S&P 500 year-to-date. Let’s take a closer look at each one.

Raytheon Technologies

Raytheon Technologies provides advanced systems and services worldwide for commercial, military, and government customers. Just recently, the company authorized a $6 billion share buyback program.

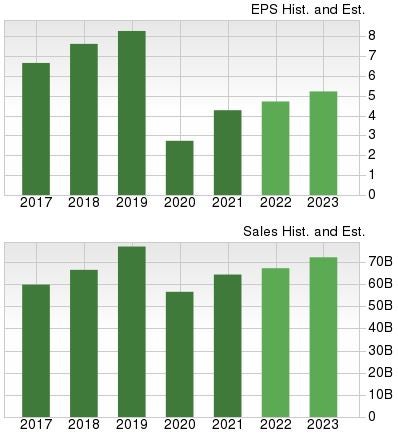

RTX sports a favorable growth profile; earnings are forecasted to climb more than 11% in its current fiscal year (FY22) and a further 9.3% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 4.3% in FY22 and 8% in FY23.

Image Source: Zacks Investment Research

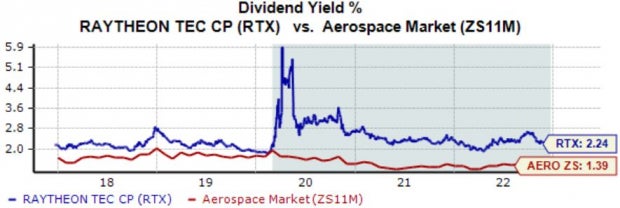

In addition, for those with an appetite for income, RTX has that covered; the company’s annual dividend currently yields a solid 2.2%, well above its Zacks Aerospace sector average.

Image Source: Zacks Investment Research

Waste Management

Waste Management is a leading provider of comprehensive waste management services in North America. Earlier in December, the company’s board approved a $1.5 billion share buyback program.

Waste Management has consistently posted better-than-expected quarterly results as of late, exceeding earnings and revenue estimates in four consecutive quarters.

In its latest release, WM exceeded the Zacks Consensus EPS Estimate by 4% and posted a marginal revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

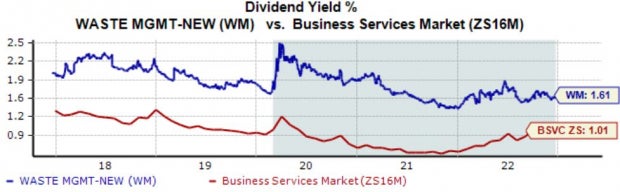

Further, WM rewards its shareholders via its annual dividend, currently yielding a respectable 1.6%. Impressively, the company has upped its payout five times over the last five years, translating to an 8.2% five-year annualized growth rate.

Image Source: Zacks Investment Research

Kellogg’s

Kellogg’s manufactures and markets ready-to-eat convenience foods, carrying a balanced portfolio of cereal and snack products. In early December, the company unveiled that its board approved a new $1.5 billion share repurchase program.

Like WM, Kellogg’s has been on an impressive earnings streak, exceeding earnings and revenue estimates in eight consecutive quarters. In its latest release, the food titan registered a 4.1% bottom line beat paired with a 4.5% sales surprise.

Image Source: Zacks Investment Research

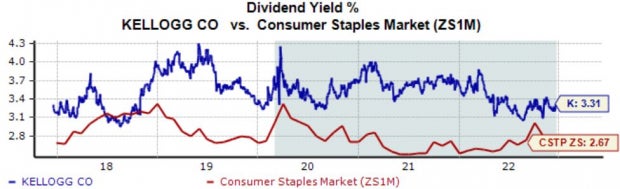

It’s impossible to ignore K’s dividend metrics; the company’s annual dividend currently yields a sizable 3.3%, well above its Zacks Consumer Staples sector average. K has grown its payout by roughly 1.6% over the last five years.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies boost shareholder value is through implementing share buybacks. In its simplest form, buybacks represent a company essentially re-investing in itself.

In addition, it can provide a nice confidence boost for investors, as the buybacks indicate that the company is utilizing its excess cash and not just hoarding it.

And in the face of a challenging economic backdrop in 2022, companies willing to dish out extra cash can be hard to find.

All three stocks above – Kellogg Company K, Waste Management WM, and Raytheon Technologies RTX – have recently unveiled repurchase programs, attempting to maximize shareholder value.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Waste Management, Inc. (WM) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.