Technology and digitalization have continued to transform business services with most product offerings now available via web platforms, enhanced digital systems, or mobile apps.

This innovative trend was catapulted by the pandemic as companies searched for technological solutions to provide customers with better service and product compatibility while staying ahead of market trends.

Currently, 17 stocks on the coveted Zacks Rank #1 (Strong Buy) list hail from the Zacks Business Services Sector. Host to a number of booming industries at the moment, the Zacks Technology Services Industry and Outsourcing Industry are two that stand out.

Here is a look at a few intriguing stocks among these top-rated Zacks industries with now being an ideal time to invest.

The Trending Technology Services Industry

Currently in the top 34% of over 250 Zacks industries, two standouts among the Zacks Technology Services Industry are Spotify Technology SPOT which was added to the Zacks Rank #1 (Strong Buy) list this week and Futu Holdings FUTU which has coveted a spot on the list since August.

As a popular music streaming services platform Spotify’s top-line expansion has attracted investors with the company rapidly approaching profitability. Total sales are forecasted to jump 14% in fiscal 2023 and climb another 17% in FY24 to $16.46 billion. Illustrating Spotify’s massive earnings potential, FY24 sales projections would represent 117% growth since the Covid-19 pandemic with 2019 sales at $7.57 billion.

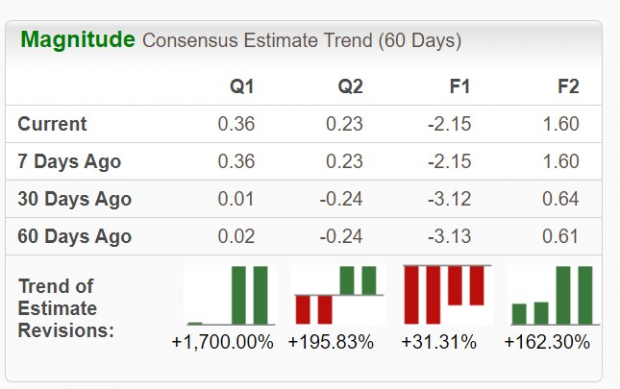

Image Source: Zacks Investment Research

Plus, FY23 earnings are expected at a narrower adjusted loss of -$2.15 per share compared to -$3.09 a share last year. Furthermore, Spotify is expected to turn its first annual profit in FY24 with EPS anticipated to climb swing into the black at $1.60 per share.

Spotify’s stock has now soared +112% this year with annual EPS estimates climbing in the last 60 days after impressively surpassing third-quarter earnings expectations in late October. Reassuringly, Spotify posted a surprise profit of $0.36 per share compared to Q3 estimates that called for an adjusted loss of -$0.21 a share.

Image Source: Zacks Investment Research

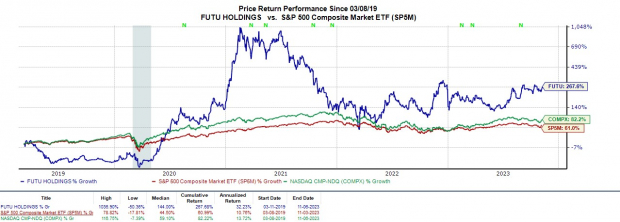

Set to report its Q3 results later this month, Futu Holdings is already profitable and remains attractive in terms of steady growth with the company providing a digitalized brokerage platform for the provision of online brokerage services and margin financing services.

Futu’s annual earnings are projected to climb 62% in FY23 to $4.23 per share compared to EPS of $2.61 a share in 2022. Fiscal 2024 earnings are expected to rise another 5%. More importantly, in the last two months, FY23 and FY24 earnings estimates have risen over 7% respectively with FUTU shares trading at a very reasonable 13.8X forward earnings multiple.

Image Source: Zacks Investment Research

On the top line, total sales are forecasted to climb 29% this year and jump another 11% in FY24 to $1.39 billion. Fiscal 2024 sales projections would be an astonishing 922% increase since Futu went public in 2019 and posted sales of $136 million. Notably, FUTU shares have climbed 62% YTD and are now up +267% since its 2019 IPO.

Image Source: Zacks Investment Research

The Highly-Ranked Outsourcing Industry

Further bolstering the Business Services sector is the Zacks Outsourcing Industry which is in the top 14% of all Zacks Industries. One of the most compelling stocks in the space is TriNet TNET which was added to the Zacks Rank #1 (Strong Buy) list last week after crushing Q3 earnings expectations in late October.

TriNet provides comprehensive human resources solutions offering payroll, tax administration, risk protection, performance management, compensation consulting, and employee benefit plans. Taking advantage of its strong business environment Q3 earnings of $1.91 per share came in 34% above the Zacks Consensus of $1.42 a share.

It’s also noteworthy that TriNet has now surpassed earnings expectations for 15 consecutive quarters and posted a remarkable average earnings surprise of 77% in its last four quarterly reports.

Image Source: Zacks Investment Research

Annual earnings are now forecasted to rise 4% in FY23 at $7.35 per share but dip -11% in FY24 to $6.56 a share after what would be a tougher to compete against year. However, earnings estimates for FY23 and FY24 are nicely up over the last 30 days with TNET shares soaring +63% YTD and still trading reasonably at 14.1X forward earnings.

Image Source: Zacks Investment Research

Bottom Line

Investing in business services stocks is very compelling at the moment with many of them holding spots on the Zacks Rank #1 (Strong Buy) list. Among the bunch, Spotify, Futu Holdings, and TriNet are very worthy of consideration as their earnings outlook continues to strengthen.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.