As second-quarter earnings continue to roll out a few top-rated stocks will be releasing their quarterly results next week. Among them are Lockheed Martin (LMT) and Omnicom Group (OMC) which are both scheduled to report next Tuesday, July 18.

Here’s a look at what’s in store for Lockheed Martin and Omnicom”s Q2 reports and why now may be a good time to buy.

Lockheed Martin (LMT)

Lockheed Martin’s stock currently sports a Zacks Rank #2 (Buy) going into its second-quarter earnings report next week.

As the largest defense contractor in the world, Lockheed Martin’s stock remains attractive with the company already securing lucrative contracts so far this year.

Last quarter CEO Jim Taiclet stated that Lockheed Martin has secured a contract for the United States sea-based hypersonic missile program, Conventional Prompt Strike (CPS), delivering the first F-16 fighter aircraft out of its new Greenville, South Carolina factory while also being selected to provide 88 F-35 fifth-generation fighter aircraft to Canada.

Image Source: Zacks Investment Research

Q2 Preview: Lockheed Martin’s Q2 earnings are expected to soar 223% at $6.43 per share compared to EPS of $1.99 in the prior-year quarter. Sales for the quarter are forecasted to be up 2% to $15.86 billion. Notably, Lockheed Martin has surpassed earnings expectations for nine consecutive quarters.

Annual earnings are now forecasted to be roughly flat in fiscal 2023 but rise 4% in FY24 at $28.13 per share. Total sales are also expected to be virtually flat this year but rise 3% in FY24 to $67.79 billion.

Image Source: Zacks Investment Research

P/E Valuation: What is most intriguing about Lockheed Martin’s stock is that at $464 a share, it currently trades at 17.2X forward earnings which is nicely beneath the S&P 500’s 21.2X. Furthermore, Lockheed Martin is the clear-cut leader in its space and trades at a nice discount to the Aerospace-Defense Industry average of 28.8X while also trading 32% below its decade-long high of 25.3X and roughly on par with the median of 17X.

Image Source: Zacks Investment Research

Omnicom Group (OMC)

Also sporting a Zacks Rank #2 (Buy) Omnicom is one of the world’s largest advertising, marketing, and corporate communications companies and is certainly worthy of investors’ attention going into its Q2 report.

With operations in most major global markets, Omnicom is starting to see stronger organic revenue growth following the pandemic and this should continue as global inflationary headwinds subside.

Image Source: Zacks Investment Research

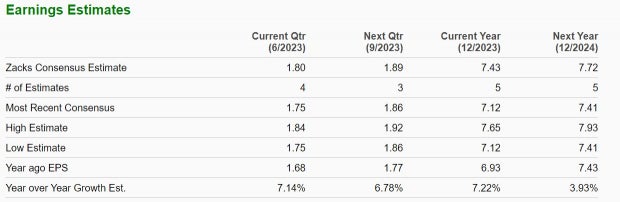

Q2 Preview: Omnicom’s Q2 earnings are expected to rise 7% from a year ago at $1.80 per share with sales forecasted to be up 1% to $3.62 billion. Even better, Omnicom has surpassed earnings expectations for an astonishing 29 consecutive quarters dating back to April of 2016.

Fiscal 2023 earnings are now projected to rise 7% and edge up another 4% in FY24 at $7.72 per share. On the top line, sales are expected to be up 3% this year and rise another 3% in FY24 to $15.23 billion. More importantly, FY23 and FY24 sales projections would eclipse pre-pandemic levels with 2019 sales at $14.95 billion.

Image Source: Zacks Investment Research

P/E valuation: With Omnicom stock trading at $96 a share its P/E valuation is also attractive at 12.9X forward earnings and well below the benchmark. Plus, Omnicom trades close to the industry average of 11.1X while trading 32% below its decade high of 19.1X and at a modest discount to the median of 13.5X.

Image Source: Zacks Investment Research

Bottom Line

Lockheed Martin and Omnicom are two giants in their respective industries that offer dividends yeilds over 2% and well above the S&P 500’s 1.41% average.

Now appears to be a good time to buy as their stocks are starting to stand out in terms of price-to-earnings valuation and both companies are expected to post strong quarterly results next week.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.