Tech stocks have been red-hot in November, delivering outsized gains. They’ve overall jumped back in favor in 2023, particularly following a tough 2022 and excitement surrounding artificial intelligence applications.

Other than tech stocks, investors also love dividends, as they can provide a nice buffer against drawdowns in other positions and a passive income stream. And interestingly enough, several tech stocks – Broadcom AVGO and Microsoft MSFT – reward their shareholders with quarterly payouts.

On top of tech exposure paired with a passive income stream, both sport a favorable Zacks Rank, reflecting optimism among analysts. Let’s take a closer look at each.

Broadcom

Broadcom, a current Zacks Rank #2 (Buy), is a premier designer, developer, and global supplier of a broad range of semiconductor devices. AVGO shares currently yield a solid 1.9% annually, nicely above the Zacks Computer and Technology sector average of 0.7%.

And the company has shown a notable commitment to increasingly rewarding shareholders, boasting a sizable 16.6% five-year annualized dividend growth rate. Please note that the chart below is on an annual basis.

Image Source: Zacks Investment Research

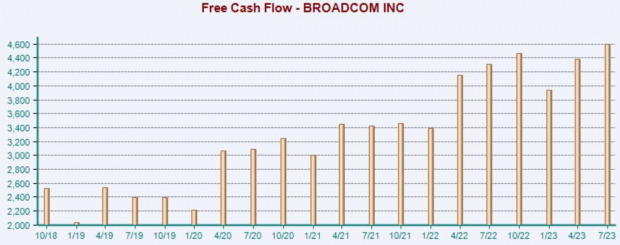

The company’s payout has been protected by the company’s impressive cash-generating abilities. AVGO generated roughly $16.3 billion in free cash flow throughout its FY22, improving 22% on a year-over-year basis.

The chart below is on a quarterly basis.

Image Source: Zacks Investment Research

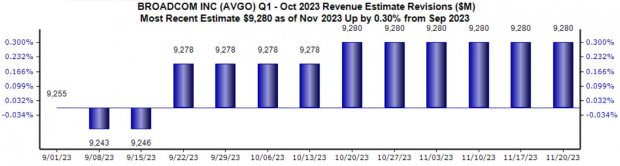

Keep an eye out for the company’s upcoming quarterly release expected on December 7th, as the Zacks Consensus EPS Estimate of $10.96 suggests growth of 5% from the year-ago period, with analysts slightly taking their expectations lower since August.

Top line revisions have been more positive, with the $9.3 billion Zacks Consensus Estimate 0.3% higher over the same period and reflecting growth of 4% year-over-year. Broadcom has been a stellar earnings performer, exceeding consensus revenue and earnings expectations in 14 consecutive releases.

Image Source: Zacks Investment Research

Microsoft

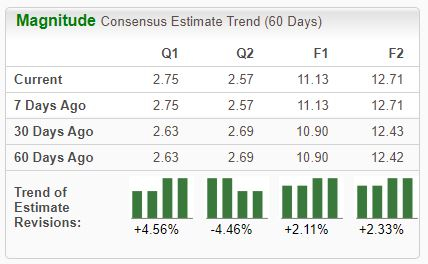

Microsoft shares have been big-time outperformers in 2023 thanks to artificial intelligence excitement and a broader sentiment shift overall. The stock is currently a Zacks Rank #2 (Buy), with earnings expectations increasing across nearly all timeframes.

Image Source: Zacks Investment Research

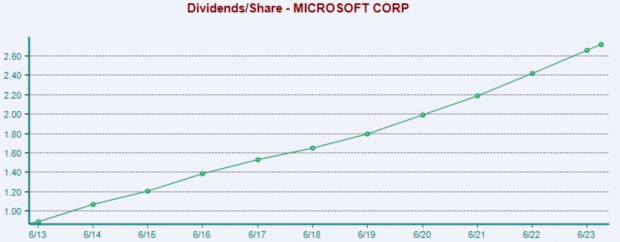

MSFT shares presently yield a respectable 0.8% annually, modestly above the respective Zacks sector average. And the tech titan has shown a commitment to shareholders, carrying a 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

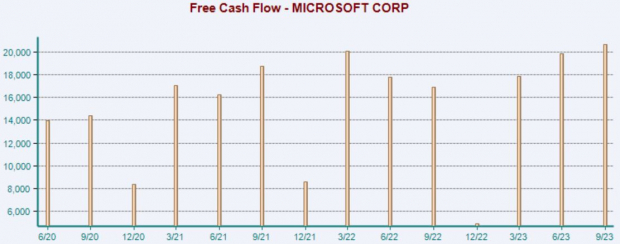

Like AVGO, Microsoft’s cash-generating abilities help secure the payout. The company generated a sizable $59.5 billion in free cash flow in FY23, with the trailing twelve-month figure totaling an equally impressive $63.3 billion.

The chart below is on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Who doesn’t love dividends? They provide a passive income stream, allow for maximum returns through dividend reinvestment, and provide a shield against drawdowns in other positions.

And who doesn’t love technology stocks? Their explosive growth and momentum in 2023 are hard to ignore, with many looking for exposure.

For those seeking dividend-paying technology stocks, both companies above – Broadcom AVGO and Microsoft MSFT – could be great considerations.

All three reward their shareholders nicely and sport favorable Zacks Ranks, with the latter reflecting optimism among analysts.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.