Semiconductors, commonly referred to as microchips, are a bright highlight of technology, existing in nearly every aspect of our lives.

Over the last several years, chip stocks have exploded in popularity, and for an easy-to-understand reason – they have been stellar investments.

And for those seeking exposure, several chip stocks – Micron Technology MU and ASML ASML – have all seen their near-term earnings outlooks shift favorably, reflecting optimism among analysts.

Let’s take a closer look at each.

Micron Technology

Micron manufactures and markets high-performance memory and storage technologies. The stock is a Zacks Rank #1 (Strong Buy), with expectations moving higher across the board in a big way.

Image Source: Zacks Investment Research

On top of semiconductor exposure, investors stand to reap a passive income stream, with MU shares currently yielding 0.5% annually. While the yield isn’t that steep, it provides a nice buffer against potential drawdowns.

And Micron’s forecasted growth is impossible to ignore, with consensus expectations for its current fiscal year suggesting 90% earnings growth on 43% higher sales. Peeking ahead, expectations for FY25 allude to an additional jump in earnings paired with a 45% sales bump.

ASML

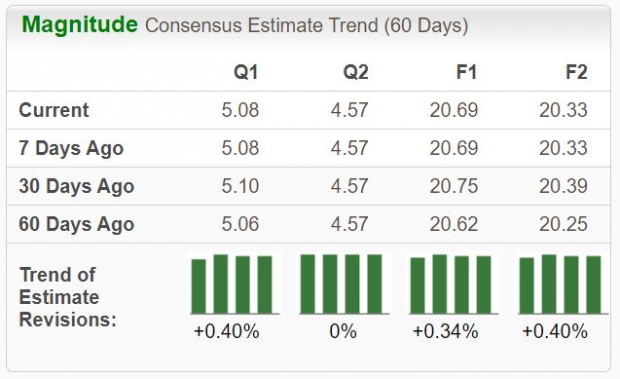

ASML is a world leader in manufacturing advanced technology systems for the semiconductor industry. The company has seen its earnings outlook inch higher across nearly all timeframes, helping land it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Like MU, ASML shares come with the perk of passive income, with ASML’s annual dividend currently yielding 0.7%. And the company has been committed to increasingly rewarding shareholders, with ASML carrying a sizable 33.4% five-year annualized dividend growth rate.

Shares are expensive but less so on a historical basis, with the current 35.5X sitting beneath the 36.1X five-year median and highs of 55.4X in 2021. The stock sports a Value Style Score of ‘D.’

Image Source: Zacks Investment Research

Bottom Line

Semiconductor stocks have enjoyed great runs over the last several years, quickly becoming cherished among investors.

And for those interested in exposure, both stocks above – Micron Technology MU and ASML ASML – precisely fit the criteria. In addition to favorable Zacks Ranks, both stocks pay out dividends, undoubtedly another great perk.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Micron Technology, Inc. (MU) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.