It’s been a notably strong week for the market, helping to inject positive sentiment following the last two weeks of volatility. Better-than-expected earnings results have helped, with the market also digesting this week’s FOMC announcement positively.

We’ve gotten results from the majority of the mega-cap technology players, with six of the ‘Big 7’ out of the way already. The lone member of the club that has yet to report – NVIDIA – is scheduled to reveal quarterly results on November 21st, a few weeks away.

Regarding next week’s docket, two quarterly reports that investors should keep an eye out for include Uber Technologies UBER and Disney DIS. UBER will report on November 7th, before the market’s open, whereas DIS will report on November 8th, after the market’s close.

Let’s take a closer look at how expectations stack up heading into the releases.

Uber Technologies

Uber’s continued business momentum supported its most recent quarterly results, with Trips growing 22% year over year to 2.3 billion and Gross Bookings 16% higher compared to the same period last year. The company also reported record quarterly free cash flow of $1.1 billion.

As we can see below, the company’s top line growth has been visibly strong.

Image Source: Zacks Investment Research

Regarding headline figures for the upcoming release, the Zacks Consensus EPS Estimate of $0.13 suggests a sizable 120% uptick from the year-ago period, with the consensus estimate remaining unchanged since August.

Our consensus revenue estimate sits at $9.5 billion, primarily unchanged during the same period and suggesting 13.5% growth from year-ago sales of $8.4 billion.

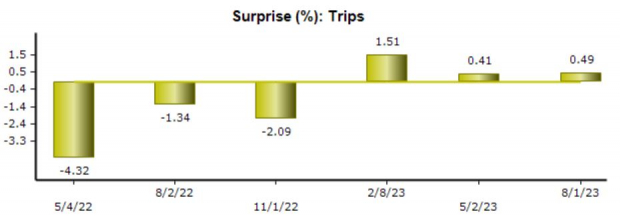

Quarterly Trips is a common metric that receives heavy focus, providing another snapshot of overall platform demand. For the release, we currently expect Uber to post Trips of 2.4 billion, reflecting a change of +21% from the same period last year.

As reflected by these expectations, business momentum looks set to continue. The company has exceeded our consensus Trips estimates in three consecutive quarters, which snapped a streak of negative surprises within the metric throughout 2022.

Image Source: Zacks Investment Research

Shares presently trade at a 2.5X forward price-to-sales ratio (F1), below the 3.6X five-year median and highs of 5.0X in 2022. The stock currently has a Style Score of “F” for Value.

Disney

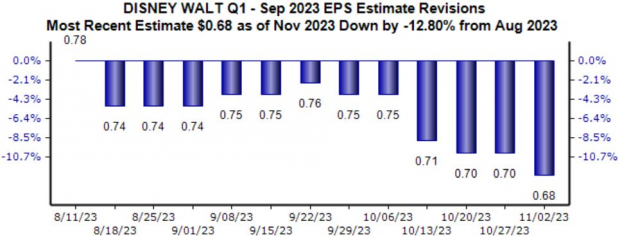

Analysts have been bearish for the quarter to be reported, with the $0.68 Zacks Consensus EPS Estimate down roughly 12% since just August. The value reflects a sizable 100% recovery in earnings from the year-ago quarter.

Image Source: Zacks Investment Research

Top line expectations haven’t seen much movement, with the $21.7 billion consensus estimate down a fractional 0.5% during the same period and reflecting growth of 6% from the year-ago period.

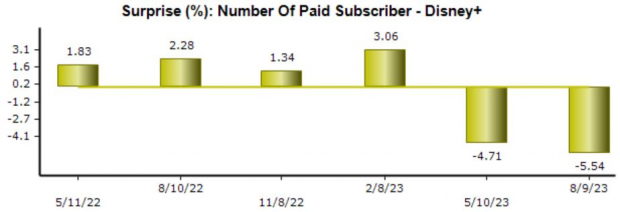

Concerning DIS, the company’s Disney+ results typically hog some spotlight, an area that’s been expected to spur growth. Currently, the Zacks Consensus Estimate for Disney+ subscribers stands at 146 million, reflecting an 11% decline from the year-ago period.

The company has fallen short of consensus Disney+ subscriber expectations in back-to-back releases, snapping a previous streak of positive beats.

Image Source: Zacks Investment Research

Still, higher revenue per paid customer has helped offset the subscriber slowdown – Domestic & International Disney+ average monthly revenue per paid subscriber saw sequential growth of 2% and 1% throughout its latest period, respectively.

Regarding its overall Direct-to-Consumer revenues, which includes ESPN and Hulu along with Disney+, the Zacks Consensus Estimate presently stands at $5.6 billion, 14% higher year-over-year.

Bottom Line

Earnings season will continue dominating headlines, with a wide variety of companies on deck to unveil quarterly results in the coming weeks.

And regarding next week’s docket, two notable releases that investors should watch include Uber Technologies UBER and Disney DIS.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

The Walt Disney Company (DIS) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.