Keeping an eye on the coveted Zack Rank #1 (Strong Buy) list the consumer discretionary sector is starting to shine again with 23 companies currently coveting spots out of 241 of these highly ranked stocks at the moment.

To that point, the consumer discretionary sector is currently ranked 5th out of 16 Zacks sectors with the Zacks Leisure and Recreation Services Industry starting to stand out in particular. In the upper 32% of over 250 Zacks industries let’s discuss two of these highly ranked stocks in the Zacks Leisure and Recreation Services Industry that look likely to move higher as the spring and summer approach.

Image Source: Zacks Investment Research

Royal Caribbean Cruises RCL

Miami-based Royal Caribbean Cruises is certainly a stock to consider as warmer weather nears with its Wonder of the Seas vessel holding the title for the largest cruise ship in the world. As the largest cruise liner by revenue Royal Caribbean has 26 cruise ships with other popular vessels being Harmony of the Seas and Oasis of the Seas.

Most importantly, Royal Caribbean’s growth has allowed the company to fend off the cyclical nature of the cruise industry with RCL shares soaring +59% over the last year despite dipping -10% year to date. Furthermore, this year’s dip is starting to look like a buying opportunity with fiscal 2024 earnings now forecasted to climb 42% to $9.65 per share versus $6.77 a share in 2023. Even better, FY25 EPS is projected to expand another 19% to $11.54 per share.

Image Source: Zacks Investment Research

However, most compelling about Royal Caribbean’s stock is its attractive valuation with RCL shares trading at 12.2X forward earnings and 1.9X forward sales. It’s also noteworthy that the Average Zacks Price Target of $135.21 a share implies 15% upside from current levels.

Image Source: Zacks Investment Research

Trip.com TCOM

Similar to Expedia EXPE in the United States, Trip.com is a China-based one-stop travel service company serving travelers to and from the People’s Republic. Of course, China’s massive population naturally makes Trip.com’s stock attractive with the company expecting high double-digit growth on its top and bottom lines but its valuation is starting to be more reasonable as well at 14.7X forward earnings.

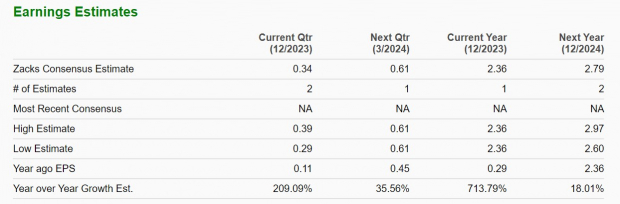

Annual earnings are expected to skyrocket 714% to $2.36 per share as Trip.com rounds out FY23 compared to $0.29 a share in 2022. Plus, FY24 EPS is projected to leap another 18%.

Image Source: Zacks Investment Research

However, it is Trip.com’s sales growth that makes its future earnings potential look more attractive and is starting to put the company in the same conversation with Expedia. Trip.com’s sales are now slated to climb 110% for FY23 to $6.2 billion versus $2.94 billion in 2022. More reassuring is that sales are forecasted to jump another 18% in FY24 to $7.3 billion.

Image Source: Zacks Investment Research

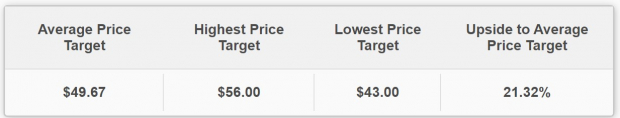

Notably, Trip.com shares are up a modest +8% over the last year after rebounding and spiking +15% YTD. Plus, the Average Zacks Price Target of $49.67 a share still suggests 21% upside.

Image Source: Zacks Investment Research

Bottom Line

Earnings estimate revisions are starting to trickle higher for Royal Caribbean and Trip.com and this could continue with the spring approaching. Furthermore, another normal peak travel season should be ahead in the summer as both companies look to build on their post-pandemic growth and recovery making now an ideal time to buy thier stocks.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.