As markets gain steam attributed to a more dovish Fed, CrossAmerica Partners (CAPL) and Ecopetrol (EC) are two appealing energy stocks to consider.

CrossAmerica and Ecopetrol’s stock both sport a Zacks Rank #1 (Strong Buy) as they are benefiting from strong business industries while offering dividend yields well over 5% at the moment.

Strengthening Earnings Outlook

Making their hefty dividends more enticing is that earnings estimate revisions are noticeably higher for CrossAmerica and Ecopetrol over the last 60 days.

To that point, CrossAmerica’s Zacks Oil and Gas-Refining and Marketing-Master Limited Partnerships Industry is currently in the top 5% of over 250 Zacks industries.

Distributing motor fuels throughout the U.S., CrossAmerica’s fiscal 2023 earnings estimates have climbed 25% in the last 2 months from $0.68 a share to $0.85 per share. Even better, FY24 EPS estimates have soared 19% from $0.80 a share to $0.95 per share.

Image Source: Zacks Investment Research

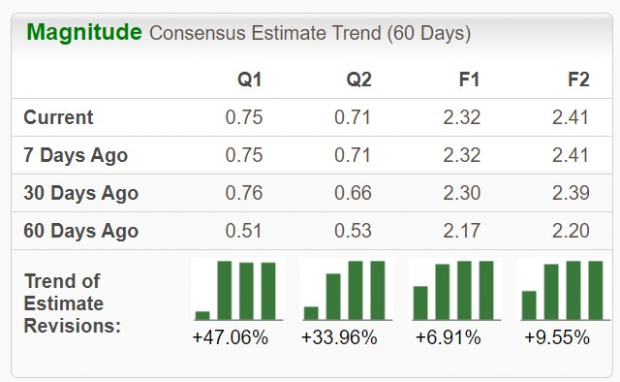

Pivoting to Ecopetrol, the Columbia-based petroleum company also has its foot in hydrocarbon renewable energy production and is starting to look like a viable investment option among emerging markets. Notably, Ecopetrol’s Oil and Gas-Integrated-Emerging Markets Industry is in the top 1% of all Zacks industries.

Over the last 60 days, Ecopetrol’s FY23 earnings estimates are up 7% from $2.17 a share to $2.32 per share. More compelling is that FY24 EPS estimates have jumped 9% from $2.20 a share to $2.41 per share.

Image Source: Zacks Investment Research

Lofty Dividends

With rising earnings estimates usually indicative of more upside, CrossAmerica has a 9.26% annual dividend yield that towers over the S&P 500’s 1.39% average and its industry average of 4.79%.

Image Source: Zacks Investment Research

Turning to Ecopetrol it currently has a whopping 18.84% dividend yield compared to its own industry average of 7.64%. While Ecopetrol’s stock price of $13 a share may bolster its yield, it’s also noteworthy that EC shares are up +24% this year and the company has raised its dividend five times in the last five years.

Image Source: Zacks Investment Research

Bottom Line

With or without their massive payouts, CrossAmerica Partners and Ecopetrol are two attractive energy stocks that look poised to move higher as markets cheer on a more dovish Fed.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Ecopetrol S.A. (EC) : Free Stock Analysis Report

CrossAmerica Partners LP (CAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.