A few travel-related stocks were recently added to the Zacks Rank #1 (Strong Buy) list. Now is a great time for investors to consider buying these stocks with travel demand expected to be higher in 2023.

Let’s take a look at two travel-related stocks that have recently been a bright spot for the Consumer Discretionary sector and offer diversity to investors’ portfolios.

Intercontinental Hotels Group (IHG)

Out of the Hotels and Motels Industry which is currently in the top 15% of over 250 Zacks Industries is Intercontinental Hotels Group. IHG offers nice exposure to hotel chains that have destinations worldwide, as an online provider of information and reservation accommodations for InterContinental Hotels & Resorts, Crowne Plaza, Holiday Inn, and Staybridge.

The U.K.-based hospitality company has operations in North and South America, Europe, the Middle East, Asia, and Africa with its top and bottom line growth starting to stand out again following the pandemic.

Image Source: Zacks Investment Research

Sales are forecasted to be up 7% this year and rise another 7% in FY24 to $3.34 billion. Fiscal 2023 earnings are now projected to jump 16% to $3.34 per share compared to EPS of $2.82 in 2022. Fiscal 2024 earnings are forecasted to rise another 9%.

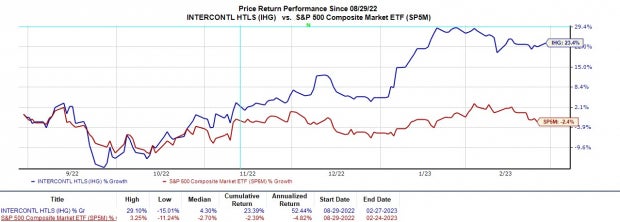

Trading at $68 a share and 20.9X forward earnings IHG stock trades well below its decade high of 291.5X and nicely beneath the median of 22.6X. Based on historical valuation there could be more upside in IHG stock with shares already up +17% YTD which has beaten the Hotel & Motel Markets’ +15% performance and easily tops the S&P 500’s +3%.

Image Source: Zacks Investment Research

Bluegreen Vacations (BVH)

Another stock that sticks out at the moment is Bluegreen Vacations which operates as a holding company for vacation ownership interests (VOI). Bluegreen stock may also have more upside with BVH skyrocketing in the past few months as well. Over the last three months, BVH stock is up +54% to easily top the benchmark’s performance and the Leisure and Recreation Services Markets +9%.

Image Source: Zacks Investment Research

This is certainly intriguing as the Leisure and Recreation Services Industry is currently in the top 20% of all Zacks Industries. Bluegreen looks poised to benefit from the company marketing and selling vacation ownership interests and managing resorts in leisure and urban destinations.

To that note, earnings estimates have gone up for fiscal 2023 as the company wraps up its FY22. Fiscal 2022 earnings are now projected to climb 21% to $3.38 per share compared to EPS of $2.79 in 2021. Plus, FY23 earnings are expected to rise another 10% to $3.72 a share.

Even better, trading at $33 a share and just 8.8X forward earnings BVH stock trades well below the industry average of 23.2X and its historical high of 188X while at a 48% discount to the median of 17.1X.

Image Source: Zacks Investment Research

Bottom Line

With these Consumer Discretionary stocks trading attractively relative to their past, their top and bottom line growth is a great sign that there could still be more upside left after their impressive rallies.

Furthermore, Intercontinental Hotels Group and Bluegreen Vacations offer diversified exposure to strong business industries that can benefit from robust travel demand, and now appears to be a good time for investors to buy their stocks.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.